Today’s Animal Spirits is brought to you by YCharts

Mention Animal Spirits to receive 20% off when you initially sign up for the service

If you’re looking to join the team, hit this link

On today’s show we discuss:

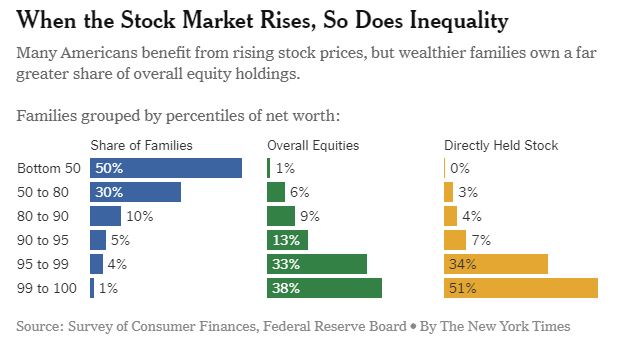

- Who owns the stock market?

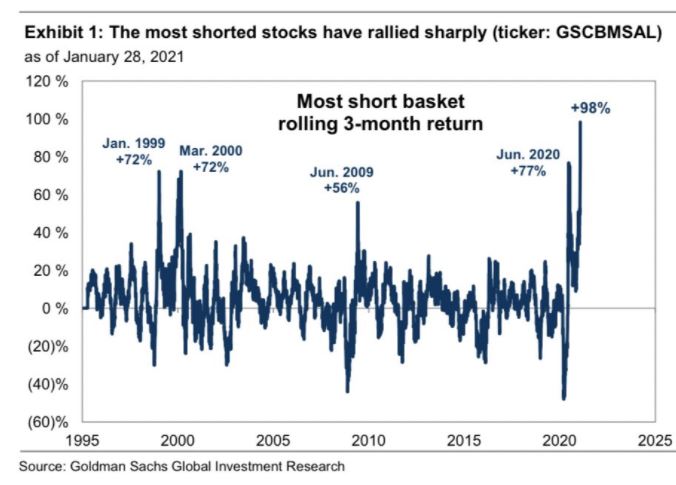

- Hedge funds got hit in the squeeze

- Melvin Capital got it the worst

- But these suits made a killing

- So did these suits

- Citron is throwing in the towel on short-selling research

- Santoli on what happened last week

- Here’s Matt Levine’s take

- Cullen on short-selling

- Robinhood’s message to customers on Thursday. They blew it

- Here’s what they said on Friday

- Robinhood drew down bank credit lines

- And they raised a lot of money

- Here’s Vlad in USA Today

- Robinhood and the Facebook comparison

- Fidelity buy and sell orders

- Nadig on where we go from here

- This story got political real quick

- Packy McCormick on how Robinhood got Robinhooded

- Robinhood wasn’t the only broker that restricted trading

- Wall Street always wins

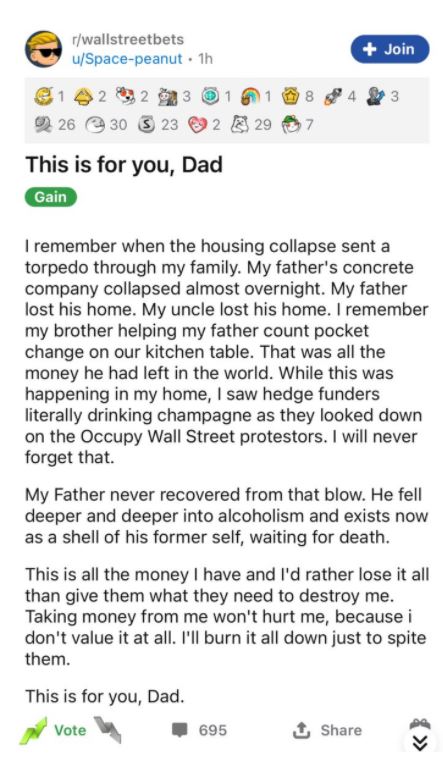

- It feels like the game is rigged

Listen here:

Recommendations:

Charts:

Tweets:

Dear Media,

What’s happening with RobinHood?

A quick primer.

This is a “plumbing” issue. It is esoteric, even for those on Wall Street.

A very long thread on how the toilet is clogged.🚽🧻🪠

Read on

👇👇👇💎💎💎🚀🚀🚀👇👇👇— Compound248 💰 (@compound248) January 29, 2021

‘THE ANTISOCIAL NETWORK’ is in the works at MGM.

The film follows the Wall Street chaos after GameStop’s stock skyrocketed due to Reddit.

(Source: Deadline) pic.twitter.com/miJvCAHDyM

— DiscussingFilm (@DiscussingFilm) February 1, 2021

So as the dust settles and today looks more and more like a balance sheet issue, I hope the lesson we can all take away is Hanlon's razor: "don't assume malice when you can assume incompetence."

Seriously. Adopt it. It'll lower your blood pressure tremendously. https://t.co/29ZbJbSFXf

— Corey Hoffstein 🏴☠️ (@choffstein) January 29, 2021

https://twitter.com/JohnStCapital/status/1354992356437721089?s=20

This is bullshit. The Redditors aren't cheating, they're joining a party Wall Street insiders have been enjoying for years. Don't shut them down…maybe sue them for copyright infringement instead!!

We've learned nothing from 2008.

Love

StewBeef— Jon Stewart (@jonstewart) January 28, 2021

r/wallstreetbets is now the largest hedge fund in the world.

Excepts it’s completely decentralized and entirely democratic.

— Chamath Palihapitiya (@chamath) January 30, 2021

Have any of you guys actually *seen* hedge fund and short seller returns the past 10 years?

If they're manipulating the system wow do they ever stink at it!!!

— Meb Faber (@MebFaber) January 28, 2021

WSB 5.0MM members, a record increase of 900K from 4.1MM yesterday.

Wall Street is building an army against itself

— zerohedge (@zerohedge) January 28, 2021

Per @S3Partners data, while the “value shorts” that were in $GME earlier have been squeezed, most of the borrowed shares that were returned on the back of the buy to covers were shorted by new momentum shorts in the name.@chamath @jarule #s3data #gmegang #tothemoon #gmestock pic.twitter.com/BGdmyp18yC

— Ihor Dusaniwsky🇺🇦 (@ihors3) January 29, 2021

Fidelity customers have been net buyers the whole week:https://t.co/sbIFcGECcz

I'd expect the same on Robinhood. Is it possible those numbers are not what was routed to Citadel, but where Citadel chose to be the counterparty? And the rest was routed onwards to the exchanges?— Scalping Billy (@ScalpingBilly) January 29, 2021

THEY DID IT: $GME was the most traded equity on the planet today w/ $20b in volume, more than $SPY, $AAPL and even the Mighty $TSLA. Surreal. pic.twitter.com/UxJPttsg4t

— Eric Balchunas (@EricBalchunas) January 26, 2021

https://twitter.com/555Sunny/status/1354854993946406917

Despite the backlash we're all seeing on Twitter.. #Robinhood ADDED an estimated 600K accounts on Friday of last week during the $GME chaos, per JMP Securities.

Webull, Sofi, Coinbase, Schwab, Fidelity.. also saw an uptick. Chart says it all. pic.twitter.com/BjDAT5twKR

— Kate Rooney (@Kr00ney) February 1, 2021

Today's action…the decile of most heavily shorted stocks was up 4.6%. The rest of the market down 2-3.5%. https://t.co/H4p1RcpfIn pic.twitter.com/lXNQWimjEO

— Bespoke (@bespokeinvest) January 27, 2021

This is beyond optimism, euphoria, or even bubble.

It is an all-out mania.

Despite the largest losses in months, small options traders nearly DOUBLED the amount of money they spent on buying calls to open last week.

That's more than $44 billion this month alone. pic.twitter.com/DAmywEug4f

— SentimenTrader (@sentimentrader) January 30, 2021

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: