I didn’t grow up with a passion for the markets. When I first developed an interest in it, I started from level 0. I knew absolutely nothing. So you could imagine how much I retained from the first book I picked up, The Intelligent Investor, written in 1949. All of the concepts were new to me, but the chapter on Mr. Market clicked and inspired me to keep going.

I’ve used this analogy in the past, that learning is like when you get a new iPhone, and it has to read your thumbprint. Every time you lift your thumb and put it back down, the phone gets better at recognizing your thumb. It’s the same thing with learning. The more you do it, the more the gaps get filled in.

An email that we’re getting more and more in the Animal Spirits inbox is “I don’t know anything about crypto. I want to educate myself but don’t know where to start.” I’ve struggled to come up with an answer because it’s such a complicated monster, but the solution I’ve landed on is pretty simple. Just start somewhere. I shared some specific things I’ve done in this post that have helped me learn.

In the beginning, I struggled to understand what was going on. It’s not just new concepts. It’s a whole new language. Proof of work and proof of stake are native to crypto. You don’t use these concepts in other fields. With crypto, you don’t just have to learn new words. You have to learn a whole new alphabet.

The good news is there are a ton of resources out there, like this incredible research report from The Block. If you’re brand new to crypto, much of this won’t make sense to you, the same way your thumb didn’t make sense to your iPhone. But the more time you put into it, the less foreign things will sound. I am still a complete novice, but I’m way ahead of where I was just 12 months ago. No shortcuts, only time.

This week, I hopped on a podcast to talk with Jeremy Schwartz and Benjamin Dean from WisdomTree, and Larry Cermak, VP of Research at The Block. We spent the majority of the conversation talking about Larry’s report and a few minutes on the RWM Wisdom Tree Crypto Index*

Below are a few snippets from The Block’s report that I found particularly interesting.

It’s been a heck of a year for cryptocurrencies. Bitcoin and Ether have done well, but their returns pale in comparison to some of the other winners. $2 into Shiba would be worth over 1 million dollars.

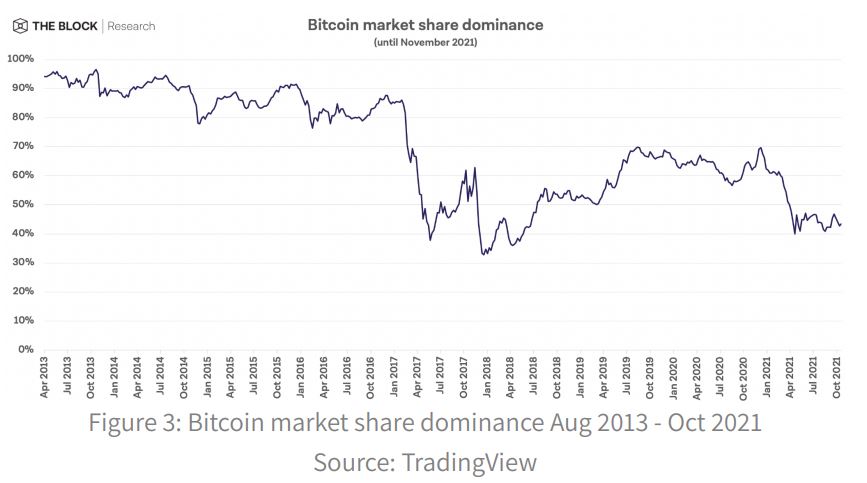

Due to the growth in other assets, Bitcoin’s market share dominance fell from 70% to start the year to 40% today.

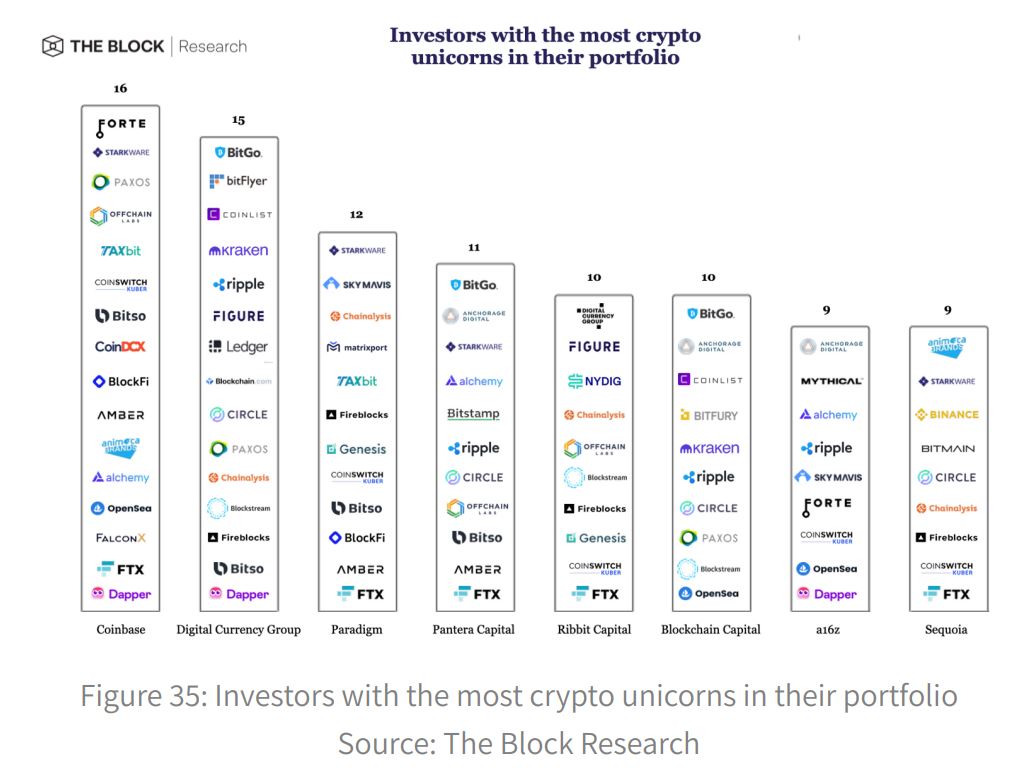

In October 2019, there were 11 unicorns in the blockchain industry. Today there are 65.

And they’re being funded by the biggest players in the industry. The top two investors with the most crypto unicorns are Coinbase and DCG, which owns Coindesk, Grayscale, and other large crypto properties.

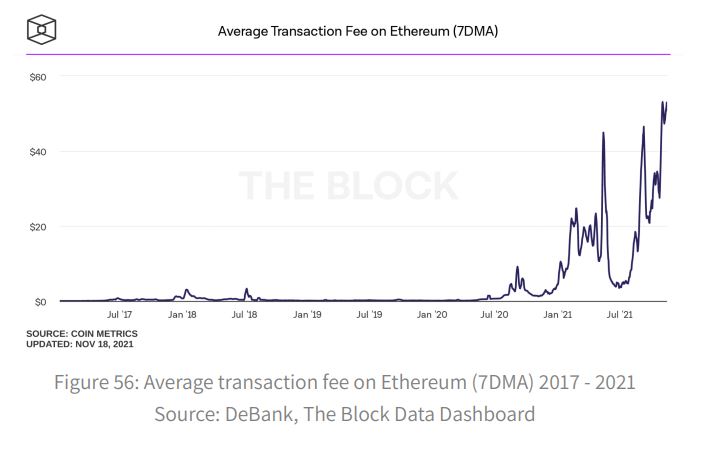

Even if you’re not too familiar with crypto, you might have seen people complaining about ETH gas fees. Here’s why.

Basically, all of the exciting stuff in the space was built on the Ethereum blockchain; NFTs, DeFi, and Dapps. But the high gas fees, which reflect demand, opened the gate up to other layer 1 solutions. According to the report, “Whereas Ethereum remained home to nearly all capital locked in DeFi at the start of 2021, its share of DeFi TVL has been chipped down to 63% as of November 30.”

There’s so much good stuff in here, but I don’t want to step on too much of it. Go check it out for yourself.

*The RWM Wisdom Tree Crypto Index (RTREE) is now live. For more information, hit this link. And get the fact sheet here.

Here’s our conversation with Larry. Hope everyone has a happy holiday/Merry Christmas.