It’s one thing to study the past after it was written, it’s another thing to experience it in real-time. Telling future generations about the lockdown cannot possibly convey what it was like to experience it.

Looking back at how crazy the numbers got during the dotcom bubble is informative, but data doesn’t tell the whole story. Luckily we have people like Corry Wang, who was working at Bernstein during the runup, to share some lessons he learned. His whole thread is worth reading, but the one that hit hardest for me was this: Everybody knew it was a bubble. Unfortunately, the quip “it’s not a bubble if everyone says it is” just isn’t true Investors were comparing the internet sector to tulip mania as early as mid-98. Bernstein held an entire conference on it in June 99!

One more time for emphasis. “It’s not a bubble if everyone says it is” just isn’t true.

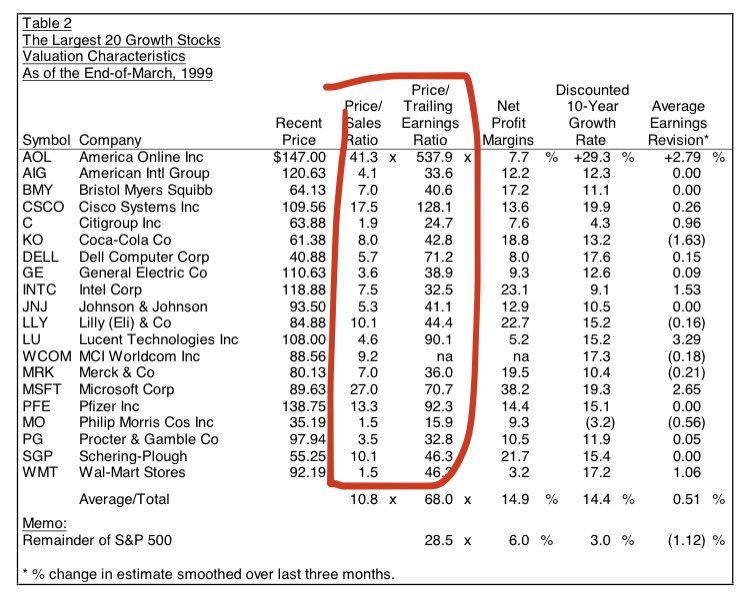

We refer to that period in time as the dotcom bubble, but as Corry points out, it was a large-cap growth bubble. 43x earnings for Coca-Cola! 41x for Johnson & Johnson! 46x for Wal-Mart!!!

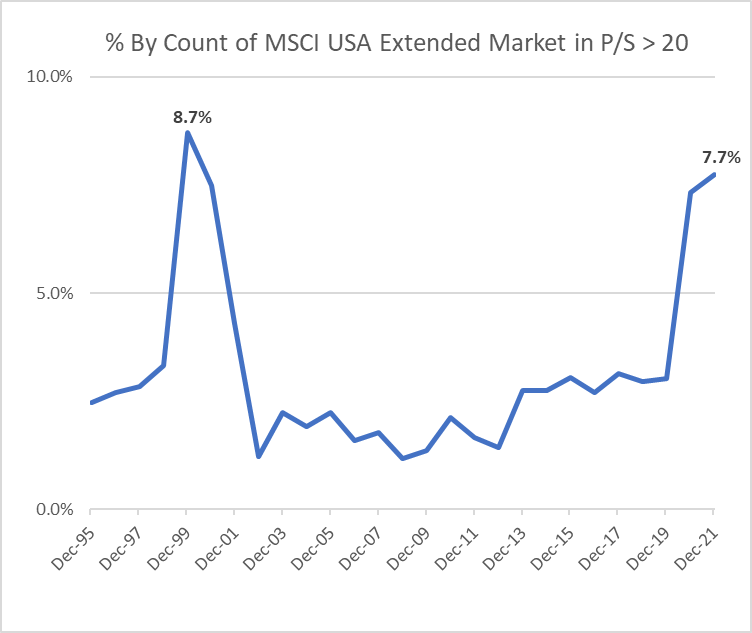

There are a lot of expensive stocks today just like there were during the dotcom bubble. Take this chart from Michael Arouet, which shows that stocks trading at 20x sales have a much larger market cap today than they did in the 90s.

Market cap of companies with Price/Sales ratio over 20 👇 Even adjusted for inflation current nonsense makes the dotcom bubble look like a period of reason and prudence. Ht @Lvieweconomics pic.twitter.com/YMEWDJySxe

— Michael A. Arouet (@MichaelAArouet) January 8, 2022

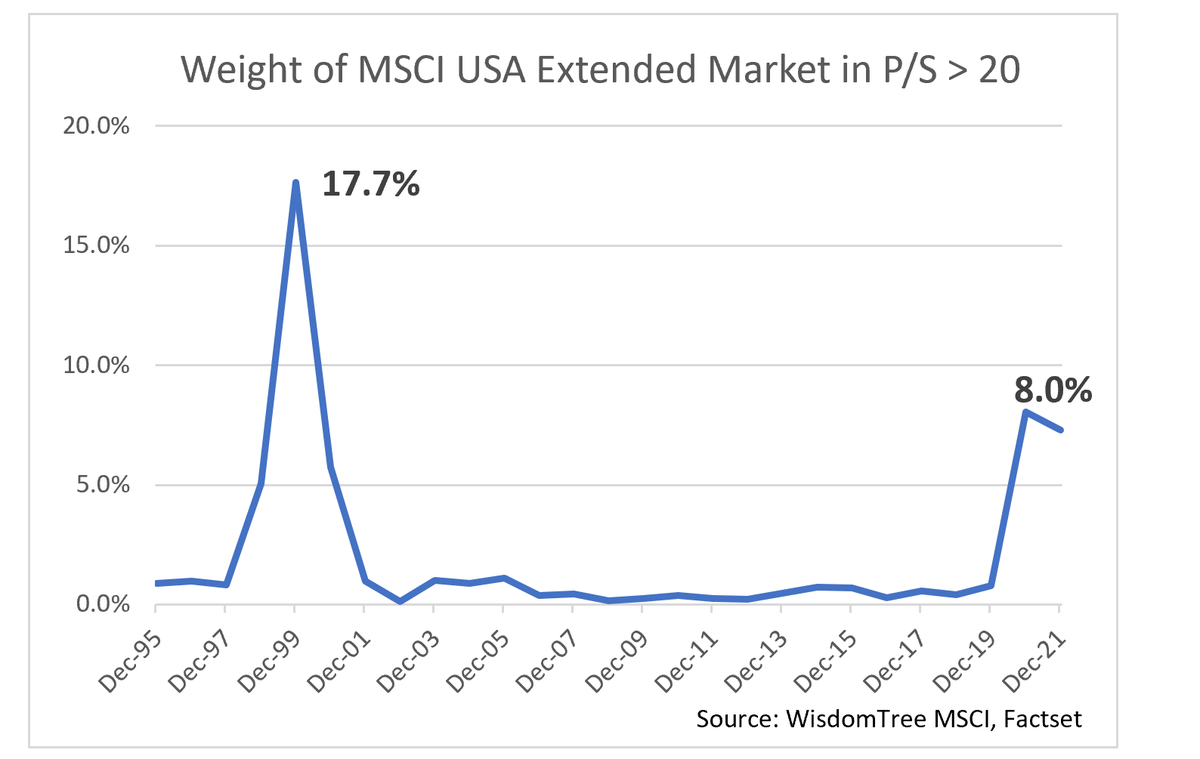

Uh oh, is it time to sell everything? I’m not saying Michael is saying that, but that is a reasonable question to ask just by looking at that chart. And while the data above is factually true, it isn’t 100% accurate because the S&P 500 market cap is 3.5x bigger today than it was back then. Jeremy Schwartz did some adjusting to make a more apples-to-apples comparison. Yes, the % of stocks trading above 20x sales is approaching ’99 levels…

…But the % representation in the index isn’t close. In the 90s, megacaps were trading at 20x sales. Today, aside from a handful of names like Nvidia, Snowflake, and Tesla, the stocks are smaller.

Today certainly has similar characteristics to the 90s. History is no doubt rhyming, but we have to remember the key part of this phrase; History doesn’t repeat. It probably doesn’t make sense to pay 90x sales for a $90 billion company (Snowflake), but it also doesn’t make sense to slavishly follow a playbook from two decades ago. If it sounds like I’m talking out of both sides of my mouth, I’m okay with that. Investing isn’t black or white.

Josh and I are going to get into this and much more on tonight’s What Are Your Thoughts?