A reader asked Ben:

If the goal is long-term investing (let us say I will not look at this money for the next 15 years), then does it still make sense to invest in bonds since equities outperform bonds over a long period of time?

I would agree with Ben’s thoughts, which is that the math says no, but the psychological constraints say yes.

But drilling a little deeper into the question, because why not, are these bonds corporate, government or municipal? And how long are you lending the money? And what is the credit rating? And are they U.S. only?

If you’re not going to look at the money for the next 15 years (hah), then it makes sense to hold significantly more stocks than bonds, as stocks have historically earned a risk premium over bonds, even long-term bonds. I thought about this today as I read an amazing data point, courtesy of Jason Zweig.

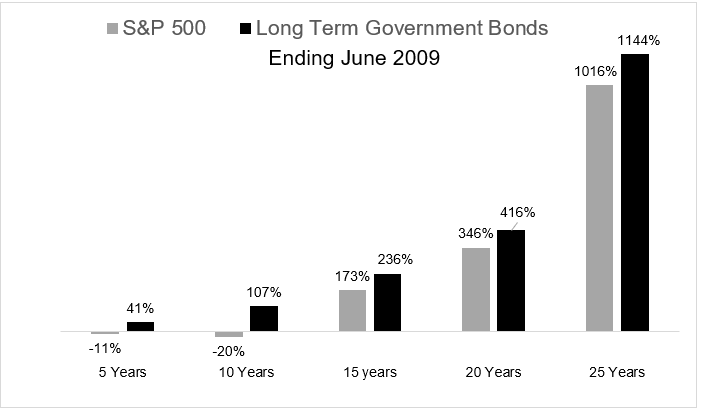

Consider an investor in June of 1984. At that point in time, stocks had beaten long-term government bonds 77% of the time over rolling five-year periods, 85% of the time over rolling ten-year periods, 89% over rolling fifteen year periods, 97% of the time over rolling twenty year periods, and 100% of the time over rolling twenty-five year periods. And then over the next twenty-five years, the iron-clad rule that stocks beat bonds over the long-term would be leveled. By June 2009*, stocks had trailed long-term government bonds over the previous 5, 10, 15, 20, and 25 years.

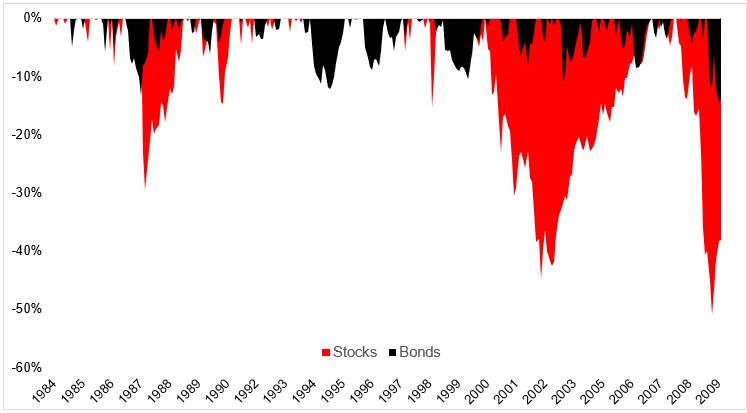

Stocks did just fine from 1984-2009, compounding at 10% a year, so it’s not as if investors who chose stocks over long-term government bonds didn’t do well (I realize it’s not an either or proposition). But there was a significant amount of pain involved on the stock side, as you can see in the chart below.

I do believe that equity investors are compensated for the additional risk they bear (yes I’m talking about volatility, sue me), so over the next fifteen years, stocks should come out ahead. But do I believe this so strongly that I would suggest you invest 100% of your money in stocks? No, I do not. And even if I was willing to pound the table on this, I’m fully aware that the journey sometimes prevents investors from reaching their destination.

How many people do you think still own stocks they bought in 1984? Over this time they’ve had to battle a 22% decline in a single day, and two separate 50% drawdowns. We all want long-term performance, but you have to survive the short-term to get there. And if that means holding bonds that will probably underperform stocks over the next fifteen years, then that seems like an opportunity cost worth paying for.

*Since June 2009, stocks are up 250%, long-term government bonds are up 60%.