“It is wise to take admissions of uncertainty seriously”- Daniel Kahneman

Apple is the biggest and one of the most carefully watched stocks in the world. It’s 50-day average volume is 49,069,563 shares, or roughly $4.8 billion a day. The buyer and the seller of every one of those shares believes they are receiving a good enough price which compels them to pull the trigger.

For the last few years we’ve heard how cheap Apple is if you “back out the cash,” spoken about the next product cycle, and debated ad nauseam whether its growth would be stunted by the “law of large numbers.” It takes some serious chutzpah to think that you have any sort of edge when trying to analyze Apple stock; to think you know something that the market hasn’t already priced in.

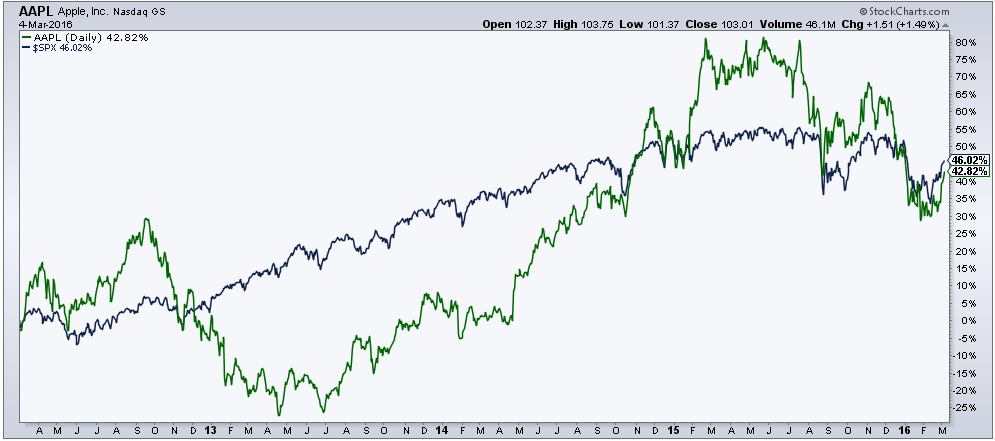

In spite of Apple’s discount to the market, or maybe because of it, over the last four years Apple has failed to keep pace with the S&P 500 (yes, I’m cherry picking).

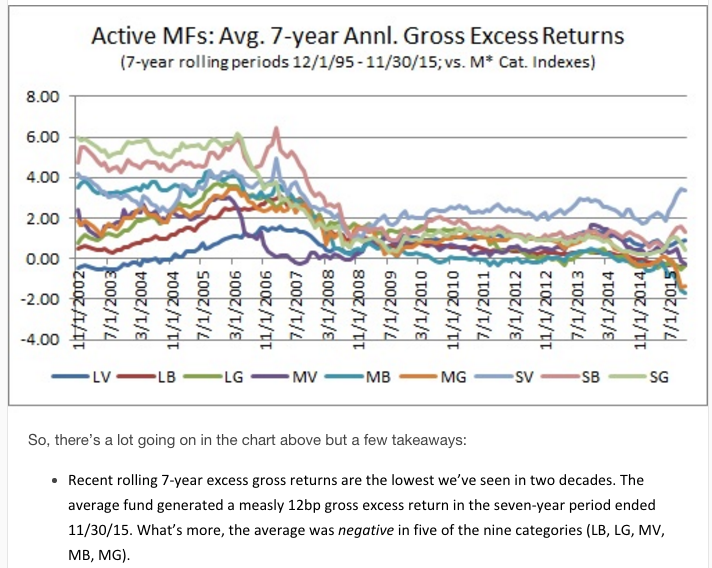

With yearly trading volume on the NYSE alone in the trillions, I’m wondering has the market ever been this hard to beat? Have we ever witnessed so many well-known hedge fund managers on the wrong side of the news? Have there ever been this many mutual funds who have failed to beat their benchmark? In fact, there hasn’t been this much underperformance in two decades, according to Jeffrey Ptak (the most under-followed person on Twitter).

As the crowd swells, maybe the years of monstrous outsized returns and star managers are behind us. Charlie Ellis has said:

“Gifted, determined, ambitious professionals have come into investment management in such large numbers during the past 30 years that it may no longer be feasible for any of them to profit from the errors of all the other sufficiently often and by sufficient magnitude to beat market averages.”

In Superforecasting, The Art And Science of prediction, Tetlock and Gardner talk about individuals versus the crowds:

In 1906 the legendary British scientist Sir Francis Galton went to a country fair and watched as hundreds of people individually guessed the weight that a live ox would be after it was ‘slaughtered and dressed.’ The average guess- their collective judgment- was 1,197 pounds, one pound short of the correct answer, 1,198 pounds. It was the earliest demonstration of a phenomenon popularized by- and now named for- James Surowiecki’s bestseller The Wisdom of Crowds. Aggregating the judgment of many consistently beats the accuracy of the average member of the group., and is often as startlingly accurate as Galton’s weight-guessers. The collective judgment isn’t always more accurate than any individual guess, however. In fact, in any group there are likely to be individuals who beat the group. But those bull’s-eye guesses typically say more about the power of luck- chimps who throw a lot of darts will get occasional bull’s-eyes- than about the skill of the guesser. That becomes clear when the exercise is repeated many times. There will be individuals who beat the group in each repetition, but they will tend to be different individuals. Beating the average consistently requires rare skill.

“Well what about Warren Buffett” you might ask. Well yes, Warren Buffett possesses that rare skill. But the fact that there are so few investors who are household names tells you how rare this rare skill is. You might also be thinking “Well what about 1929? 2000 and 2008? Yes, there are some extreme moments in time when it pays to bet against the crowd. However, harnessing the wisdom of crowd is the best idea 99% of investors will ever have in their life. And with the crowd growing so large, if you find this line of thinking to be controversial, I’ve got some deep out of the money calls to sell you.

Source: