In a recent Bloomberg article, Luke Kawa writes how investors are positioning themselves as interest rates rise:

Cumulative inflows into the iShares Short Maturity Bond ETF (NEAR), Floating Rate Bond ETF, SPDR Bloomberg Barclays Short Term High Yield Bond ETF, PowerShares Senior Loan Portfolio , and the Vanguard Short-Term Corporate Bond ETF topped $400 million in total for the first session of the week, the highest since the inception date of the most recent member of this product group. One thing all these offerings have in common: low duration.

Anecdotally I can confirm that investors are indeed worried about how bonds and bond funds will behave if rates continue to rise. I would argue, however, that they’re worries are misguided. The sense I get is that they’re not just worried about their fixed-income returns falling short of expectations, they’re freaking out about a full blown meltdown.

The ten-year rate went from a low of 1.40% in July to as high as 2.40% last week. Over this time, particularly in the last few weeks as rates have gone higher, bonds have gotten “crushed.” TLT, the ETF representing one of the most sensitive parts of the bond market, has fallen 16% from its highs in July (It remains up 1.6% on the year). BND, the total U.S. bond market is 4% off its highs, and is up 2.3% YTD.

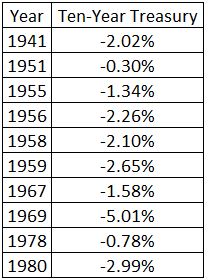

People are acting as if there has never been a period of rising interest rates. In January 1941, the 10-year treasury was yielding 1.95%, by September 1981 it was up to 15%. Over that time, ten-year bonds had nominal losses just ten times, with the worst annual loss at 5% (table below). When bonds get crushed, it’s not the losses you see on your statement that get you, but rather the losses you feel when you go to the grocery store.

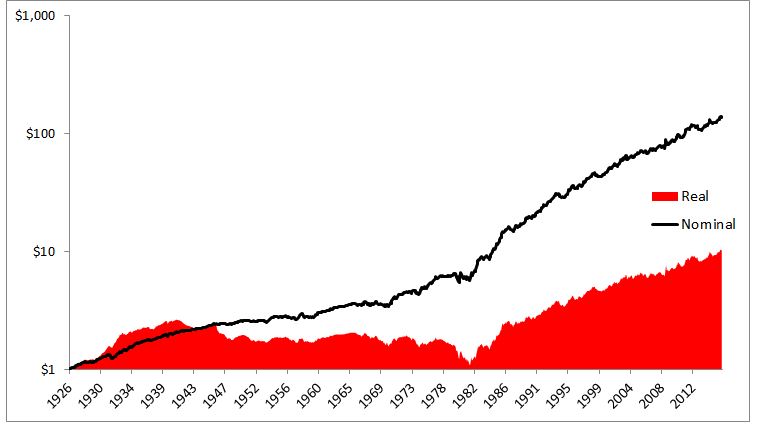

Inflation is a much greater threat for bond holders than rising rates. Below is the real and nominal growth of $1 for a *bond portfolio. All that white space is inflation. People often point to how risky stocks are by citing the Great Depression. Stocks peaked in 1929 and didn’t regain those levels until 1955 (1945 if you include dividends). Adjusted for inflation, a portfolio of bonds peaked in 1940 and didn’t return to those levels until 1989, 49 years later!

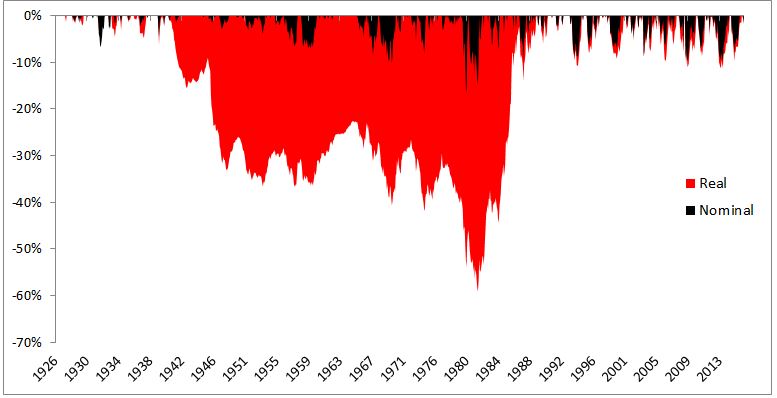

Below is another visual supporting the fact that inflation, and not rising interest rates, is the real enemy of bonds. You can see in the past they experienced shallow nominal losses, only exceeding 10% three times. Conversely, when adjusted for inflation, 10% drawdowns happen all the time and real losses approached 60%, as bad as any equity drawdown outside of the Great Depression.

There are two types of risk that investors should think about: The first is short to intermediate-term risk, and I would put into this category anything that can throw you off your plan. For example, having too much exposure to stocks in a bear market or having too little exposure to stocks in a bull market. The second, and probably more meaningful one is long-term risk. I would define long-term risk as failing to achieve the returns you’re counting on for a comfortable retirement. Bonds currently fit into this category. The real annualized return on the bond portfolio I referenced earlier is 2.6%. Unless you’re an excellent saver, this just isn’t going to get it done.

Like everything else in life, there are trade-offs, and the most important thing is striking the right balance between these two types of risks. On the one hand, you want to hit your long-term goals, and on the other, you have to be able to survive the short to intermediate-term in order to get there.

I’ll end with this; the idea that rates have only one direction to go is nonsense. Nobody knows what the future holds for bonds anymore than they know what the future holds for anything else. The best you can say is that future bond returns, with a starting yield of 2.5%, is going to be less than it was 30 years ago when rates were double digits. Adjust your expectations accordingly. The ultimate question is, does a change in expectations demand a change in your overall portfolio? That’s up for you to decide.

*The bond portfolio is 10% one-month bills, 15% five-year notes, 35% long-term corporate bonds, and 40% long-term government bonds.

Source:

There’s a ‘duration rotation’ ahead of the Fed.

Dimensional Returns 2.0