A reader asks:

What aptitudes and/or mentality would a given individual need to have for you to hire them with no college education?…From the way it has been spoken about to me from people in the finance industry, it seems as if they view it as nothing more than period of time you just have to pay your dues at before getting a job. I’m interested to know what your perspective on college is. My parents are always frustrated with my skepticism of it because I start in just a month now, but it just simply doesn’t make financial sense to me. I haven’t paid for a bit of my current education except for a Barron’s subscription my junior year, and I’ve been able to learn more than any adult I know as far as family and friends, and even a bit more than the people I’ve been able to meet with. That being said, I am concerned about dropping thousands on a college education. I don’t want to find my self at a bar someday getting called out by a born genius for spending several grand on an education I could’ve got for a dollar fifty in late charges at the public library.

My response:

I completely understand where you’re coming from, however, I do think college is beneficial in the sense that it can be something of a bridge to adulthood. At 18, you, and I don’t mean you specifically, I mean most people, just don’t know a lot because they haven’t had much life experience. I was a child when I went into college and a child still when I came out. We all come into our own at different points in our lives, I’m only telling you what it was like for me.

For some background, I didn’t have a great college experience. I got kicked out of Indiana University for not giving a shit and not going to class. I say this not because I’m proud, but to let you know that I think a college education is a good idea for many people, even though I didn’t benefit from it.

I agree that you can learn far more from listening to Patrick’s podcast than you will at school, but for better or worse, people want to see a degree, especially in finance. The biggest benefit I can see is that it provides you with a potentially huge network and while that might not seem like it’s worth tens of thousands of dollars, absent that, you’re facing a considerable disadvantage.

Would I hire somebody without a degree? Well, it depends for what role. I can say unequivocally that I would not hire a high-school graduate to be a financial advisor. One of the most important roles for an advisor is to, well, advise, and at 18 years old, not enough life has been lived to guide somebody. Now, ten years out of school, if I saw skills that can’t be taught, like ambition, coach-ability, and a good personality, then yes, I would absolutely hire a person that possessed these traits, regardless of a college education.

I understand why your parents are giving you some push back, and I also understand where you’re coming from. Of course people have accomplished extraordinary things without a degree, but I think it makes the difficult task of finding a good job/career that much more difficult.

Hope this helps.

Michael

***

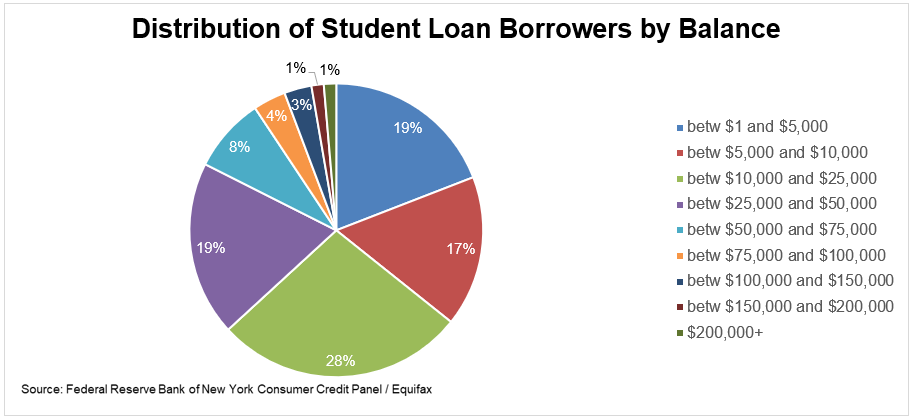

After I emailed this person, I wanted to get a better sense of what the student loan market looks like. We hear about all sorts of scary gigantic numbers, but if you dig under the hood, the situation looks far from catastrophic for most people. 63% of borrowers owe less than $25,000. Less than 10% of borrowers owe more than $75,000.

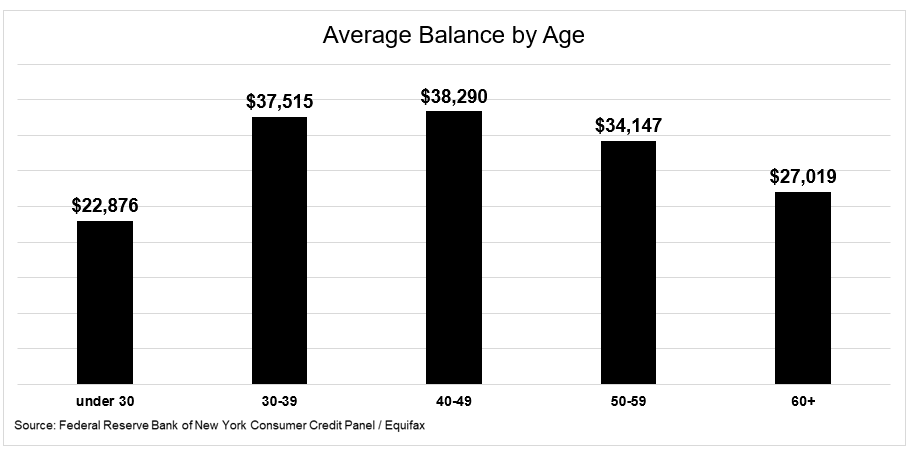

The chart below shows the average balance broken out by age group. Again, not the dire picture that we so often hear about.

The current education system leaves a lot to be desired, and college definitely isn’t for everyone, but if you are looking to get into a traditional role in finance, it would be hard for me to recommend that you skip it.

***

Earlier today I tweeted that $85 billion in student loans are held by people over the age of 60.

I emailed the data providers and asked if the people in the age group 60+ loan originators, or are they parent plus loans, where they’re just co-signers?

Here is the answer I received.

We’re not able to directly identify whether someone borrowers for themselves or for their children, so we’re not able to see this easily. We do see some origination though among the oldest group (which we suspect is a bit of both as parents and for themselves), although much of these balance are also slowly paid down older loans that were originated when the borrowers were younger. Note that parent plus loans are typically not cosigned and are only the responsibility of the parents.