“Should I get out of the market?”

This is a question that ought to be eliminated from the investor lexicon. Healthy investing, like everything else, is all about moderation. Take Obi Wan’s advice, “Only a Sith deals in absolutes.”

In a perfect world you would determine what you want from your life and how much it would cost to support it. Next you would look at your savings rate, extrapolate this out into the future, and then back into the returns required to accomplish your goals. You would then do your best to come up with reasonable return expectations (the more conservative, the better). Finally, you would determine the appropriate mix between stocks and bonds. In a perfect world, you would set it and forget it.

The world of stocks and bonds does not allow for perfection. Things have a tendency to get in our way.

The most likely wrench that knocks us off our course is ourselves. We use short-term declines as an excuse to abandon a long-term plan. We see our account go down and feel the need to do something. Few people are immune from this very human reaction.

The behaviorally aware investor has a plan in place to insulate themselves from their worst instincts, which is to sell everything when stocks decline and buy back only when “the dust has settled,” whatever that means.

Today I want to talk about practical tactical asset allocation. This is not advice. Please talk to your financial advisor, your accountant, your spouse, etc.

The portfolio is: 70% MSCI World Index TR, 30% Bloomberg Barclays U.S. Aggregate Bond index, annual rebalance. Here are the hypothetical rules:

- Invest in the 70/30 portfolio until the account shows a 10% decline from its peak end of month balance.

- At that point, switch to the “flex” portfolio, which takes you from 70% stocks and 30% bonds to 70% bonds and 30% stocks.

- Once your portfolio makes a new end of month closing high, switch back to the 70% stock 30% bond portfolio

The chart below shows the growth of $1 using buy and hold versus the flex strategy. This is shown gross of any transaction costs and taxes, aka real life.

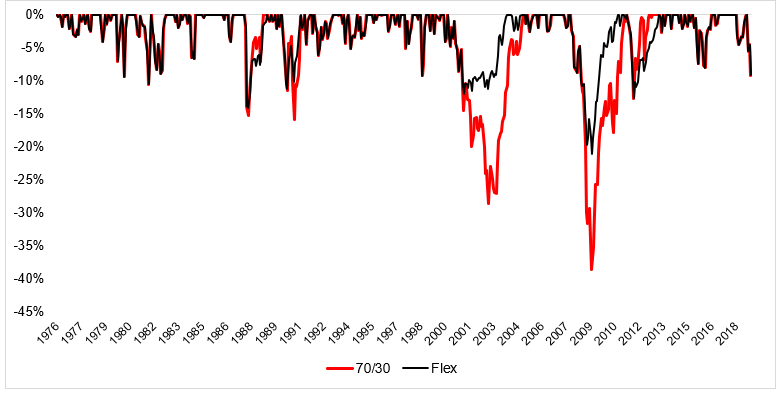

One of the reasons why this back test looks so strong is because there was a significant amount of luck involved (I did not test 80/20 and 60/40 as I don’t think these details matter). For example, this portfolio was down 5.3% in January 2001 and down 10.7% in February 2001 when it switched to the flex. Pretty much the same thing happened in 2008. It could have easily been down 9% and then exited the following month in a 17% drawdown. Anyway, you can see the drawdown between buy and hold versus the flex portfolio below.

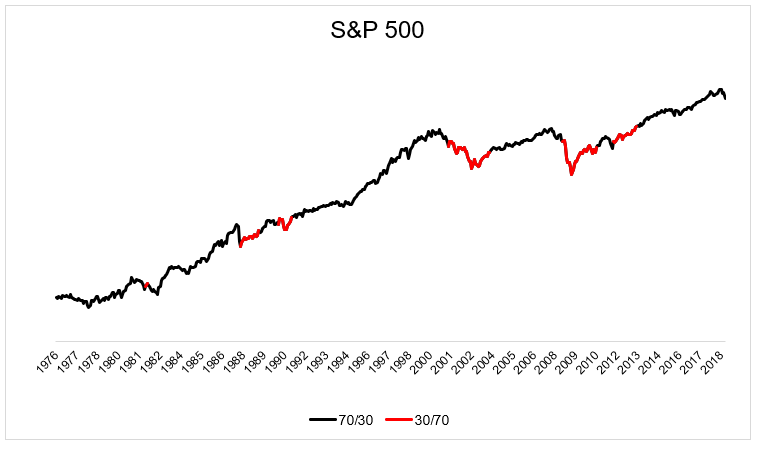

The chart below shows when you would have been invested in the 70/30 version versus the flex portfolio. I used the S&P 500 as an illustration, even though the model used the All Country World Index.

If you know you have a tendency to get nervous when markets start to wobble then it makes good sense to implement something like this ahead of time (again, this is not advice). This accomplishes a few things:

- It eliminates the all in or all out mentality and mitigates a lot of our biases

- It allows you to sleep at night in a really nasty market

- It takes the pressure off of you to make directional calls on the market based on fear and or intuition

Thinking in terms of in or out is a great way to guarantee that you’ll experience a lot of regret. Regret leads to anger, anger leads to Star Wars quotes, etc.

Jack Bogle was famous for saying “Stay the course.” This is sound advice, but it assumes investors have a course in the first place. Many are flying blind. If you don’t have a course, find one, and then stay on it.