A listener asks:

“Does the 60/40 Portfolio still provide adequate diversification in a negative interest rate world?”

This question was triggered by this article, The Death of the 60/40 Portfolio.*

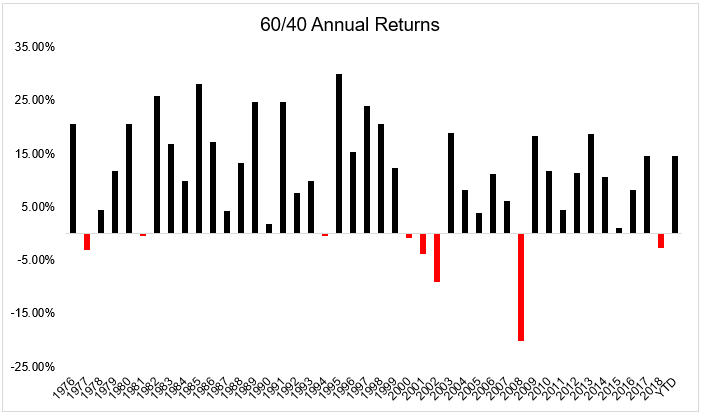

First, some quick history. A traditional mix of U.S. stocks and bonds has delivered an annualized 10.15% since 1976, with positive returns in 35 of 43 years.

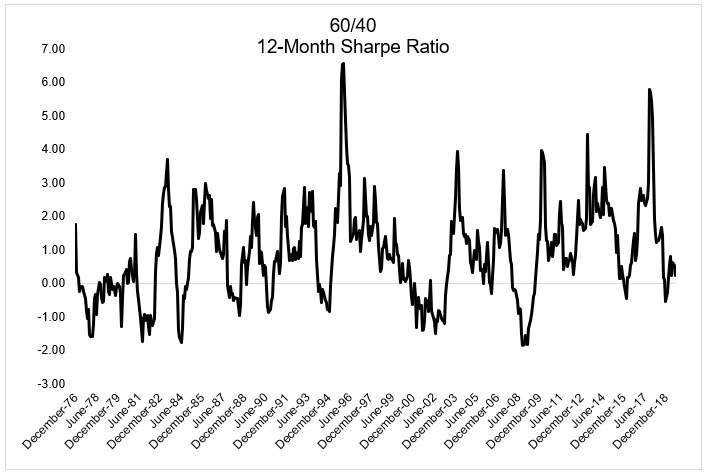

This simple, boring portfolio has been a formidable opponent, delivering mostly positive risk-adjusted returns.

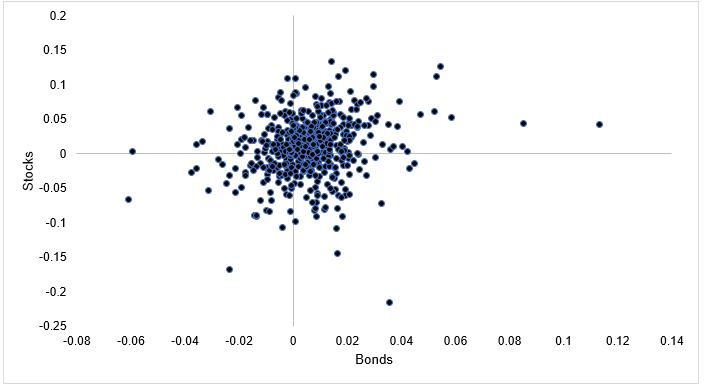

One of the reasons it’s been able to do this is the fact that bonds have zigged when stocks zagged. I typed this sentence and then went looking for data. Then things got awkward because I didn’t find what I expected to.

Below is a scatter plot of monthly stock and bond returns.

When stocks had bigly monthly declines, bonds didn’t always hold up their end of the bargain. This one caught me by surprise: Since 1976 when stocks had a down month, the average return for bonds was 0.31%. When stocks had an up month, the average return for bonds was 0.76%. ¯\_(ツ)_/¯

Diversification doesn’t necessarily show up over every thirty-day period but the main reason why a 60/40 portfolio did so well over the last few decades is because stocks and bonds did so well over the last few decades. It’s really that simple. I’m not saying stocks and bonds don’t go together like peanut butter and jelly, but I was surprised by this.

Back to the matter at hand. Will a 60/40 portfolio provide adequate diversification in a negative interest rate world?

This is not a black or white question because not everybody will agree on what adequate diversification is. Further complicating matters is the fact that we’ve never been in a world of negative interest rates. What we do know for sure is that starting rates are the primary driver of future bond returns and with rates across the curve at ~2%, we shouldn’t expect that much from our bonds.

Unless, and I wouldn’t count on this, but what if rates continue to go lower? This can’t happen in perpetuity, but is it impossible that the 10-year finishes 2019 at 1%? And the next year at 0.5% and so on? And how would this affect the stock market? I mean, in textbooks lower rates makes stocks more attractive but what the hell would negative rates say about the overall economy? I’m hoping we never find out.

There is no law saying you must have 60% of your portfolio in U.S. stocks and 40% in U.S. bonds. You could add cash and gold. You could add foreign stocks and bonds. You could add trend following. You could add crypto currencies. You could add whatever you want, but in a world where interest rates are sub 2% everywhere you look, common sense would suggest you lower your return expectations.

It’s great that a 60/40 portfolio is up almost 15% in 2019, but at some point double digit returns will be a fond memory. Lower your expectations and you’ll be just slightly less disappointed if and when they arrive.

*We had a whole panel debate the death of the 60/40 portfolio at our conference in November 2016. Since that time,it has grown at an annualized 10.4%