On today’s show we discuss:

- A hub for help during the Coronavirus

- Danny Meyer’s USHG lays off 80% of their total workforce

- Restaurants will need a miracle

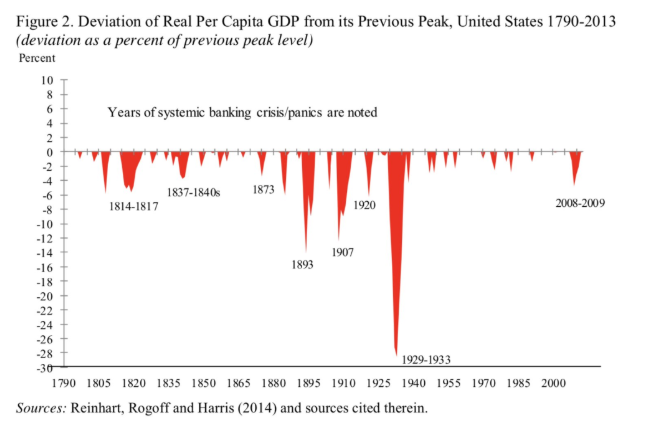

- Is 20% unemployment coming?

- Hedge funds are outperforming

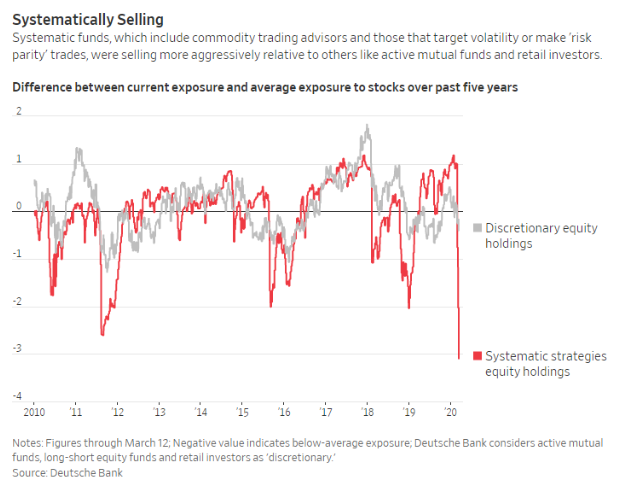

- Why markets are so volatile

- Postponing tax payments

- GM shutdown, but they’re going to help

- What happens to advertisers in a recession?

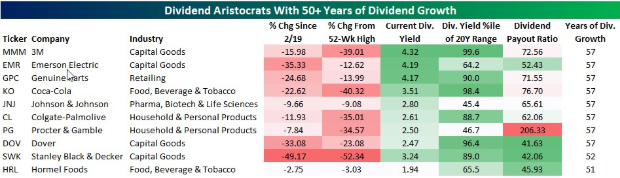

- Cash is all that matters

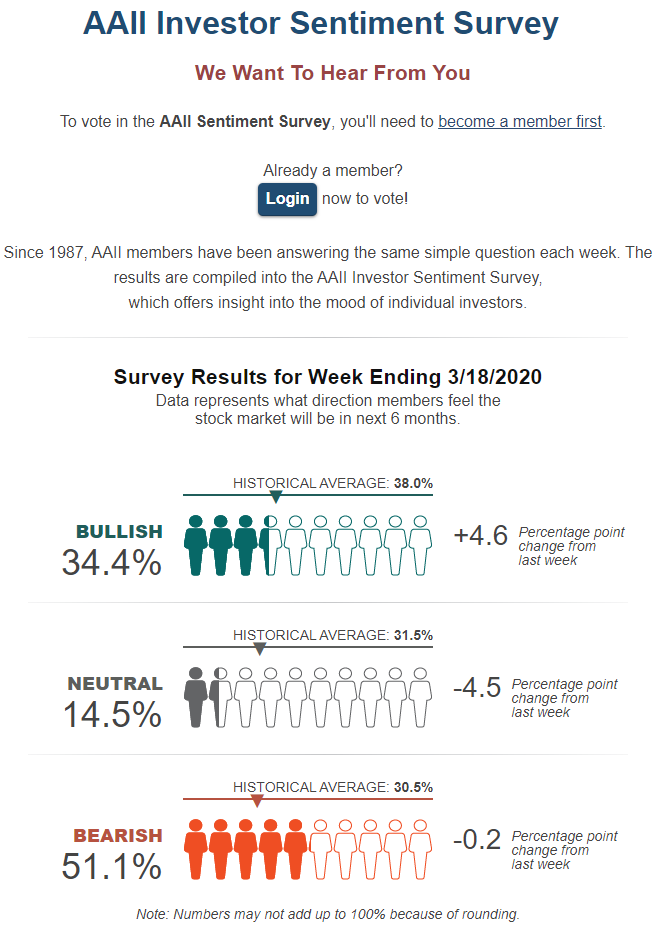

- Sentiment survey

Listen here:

Charts:

Tweets:

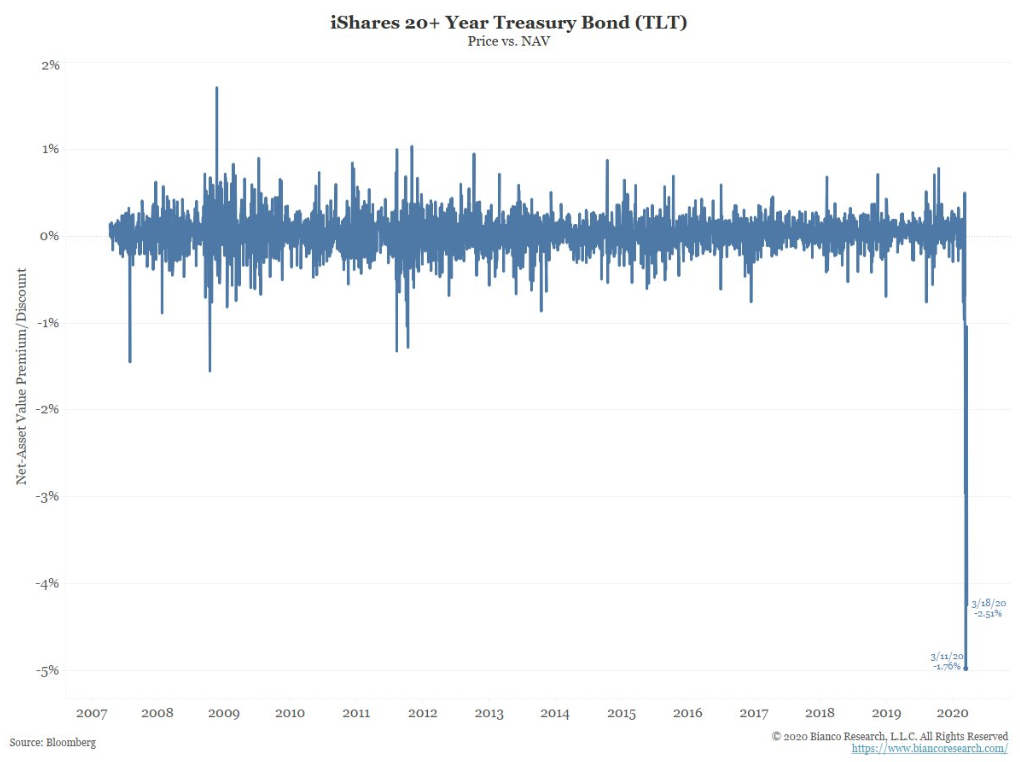

We don't have a flight to quality, we have a flight to cash.

-Howard Mason— RenMac: Renaissance Macro Research (@RenMacLLC) March 19, 2020

Investors are paying for the privilege of getting their dollars back in a month. The rate on 4-week T-bills has gone negative. pic.twitter.com/hcBGBDjyKn

— Lisa Abramowicz (@lisaabramowicz1) March 18, 2020

WOW JPM: "…we are slashing our forecast for real annualized GDP growth in Q1 to -4.0%, followed by an even weaker -14.0% in Q2… growth partly recovering to 8.0% in Q3 followed by 4.0% growth in Q4."

— Sam Ro 📈 (@SamRo) March 18, 2020

https://twitter.com/tpsarofagis/status/1240596914665672706

Assuming testing capacity and efficiency is one of the key things to alleviate economic lockdown and freeze (which deeply hurts everyone), the pathetic ramp of testing capacity in the U.S. will go down as one of the most tragic failures in our history. pic.twitter.com/q4bJ0ELQVj

— Patrick OShaughnessy (@patrick_oshag) March 18, 2020

https://twitter.com/ferrotv/status/1240042395598807040?s=12