“There are limits to size and growth”

-Geoffrey West

The S&P 500 has had annualized revenue growth of 3.5% over the last decade. I heard this from Chris Bloomstran during a conversation with Patrick O’Shaughnessy. They were talking about this in the context of why tech can’t continue to grow at the breakneck pace that we’ve grown accustomed to.

Facebook, Amazon, Apple, Microsoft and Google, which I will refer to as FAAMG, have grown their revenue at 15% a year since 2012, and are now the 5 largest stocks in the S&P 500. If this growth rate were to continue, in 19 years these five companies would be responsible for half of the revenue in the index. 7 years later they would have more revenue than the index itself.

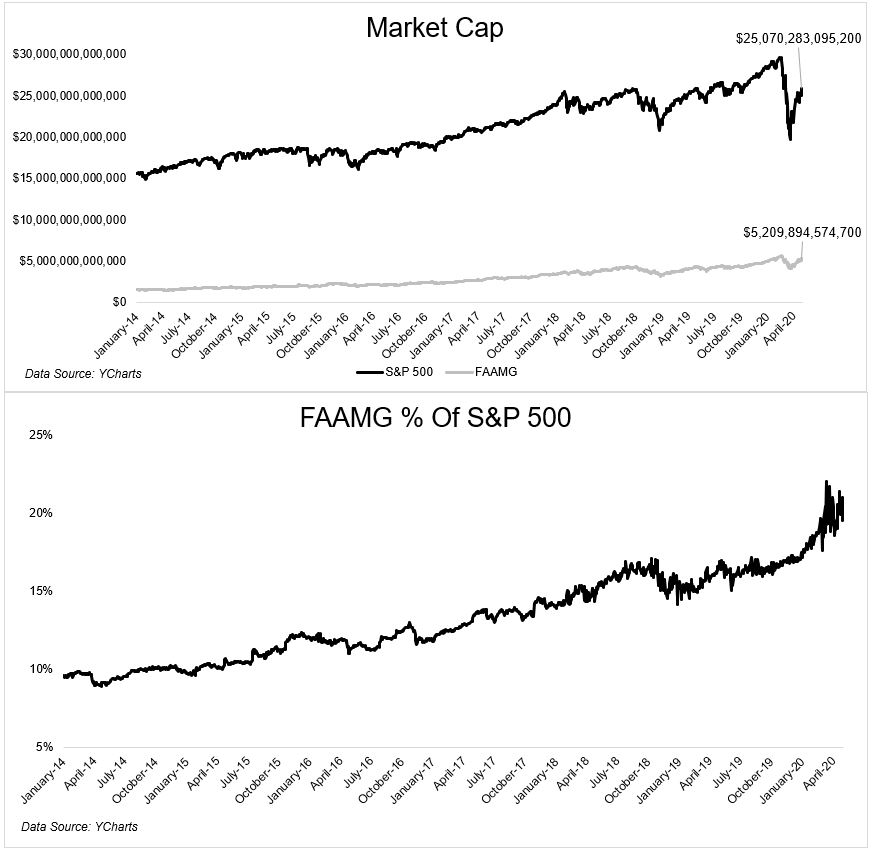

Since 2014*, the market cap of the S&P 500 grew at an annualized rate of 7.7%. Over the same time, the market cap of the FAAMG stocks grew at 21.6%, and now represent roughly one-fifth of the index. If these growth rates were to continue, in 7 years these 5 stocks would represent half of the index in terms of market capitalization. 6 years later, they would represent the whole thing. For reasons that are very obvious, this cannot happen.

The biggest stocks have been getting bigger for the last decade, and the COVID-19 induced recession is widening that gap further still. The FAAMG companies all recently reported earnings, and for the most part, things are much better at the top than they are everywhere else.

Eventually, this growth is going to be a headwind, not just because it’s harder to grow from a base of 100 than from a base of 10, but because sooner or later, Uncle Sam will come knocking.

How long before Amazon is forced to spin out AWS? How long before Facebook and Instagram have a forced separation? I’m not predicting this does happen, I’m only pointing out that if these growth rates were to continue, then it will happen.

Betting against this winner-take-all trend has been a losing proposition, but an iron law of pizza is that the slices of the pie cannot be bigger than the pie itself. An iron law in investing is that five stocks cannot be bigger than an index with 495 other constituents.

*I used this as a start date because that’s around the time Facebook got added to the S&P 500. Also worth noting that the data I have uses the market cap of each S&P 500 company today going back in time. Not every company today was in the S&P 500 in 2015, and some companies that left are no longer being reflected. All that said, these numbers should be very close, even if they’re not precise.