The stock market falls because people want to sell and people want to sell because the stock market falls.

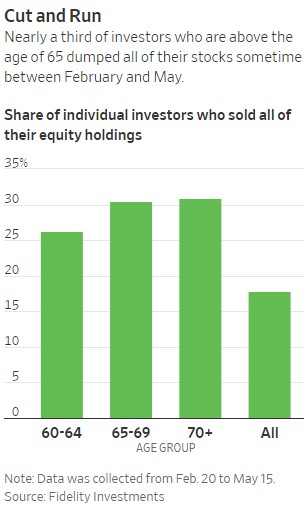

Fidelity has the receipts. They showed that nearly one in five investors sold all of their stocks some time between February and May.

Selling all of your stocks when the market is crashing is never a good idea. This isn’t hindsight talking, this is just a fact. When you take your stocks down to zero, you tell yourself that you’re going to get back in lower or when the dust settles.

Nobody gets back in when the dust settles and here’s why- If you sold at 10, and the market goes to 9, you think it’s going to 8. If you sold at 10 and the market goes to 11, you’re going to wait for it to come back to 10. It might or it might not. And if it does come back to 10, you’re probably going to wait to see if it drops to 9.

There is nothing wrong with making a change to your portfolio if you discovered that your tolerance for risk is not as high as you previously thought. But going from 100 to 0 is never the right answer because it makes the next decision almost impossible.

Josh and I spoke about this and more in our latest What Are Your Thoughts?