The Covid economy has been a tailwind for companies that didn’t need any help. Exhibit A, Amazon.

North American sales in the second quarter came in at $55.44 billion, up from $38.65 billion a year earlier. That 43% growth is remarkable considering how large these numbers are.

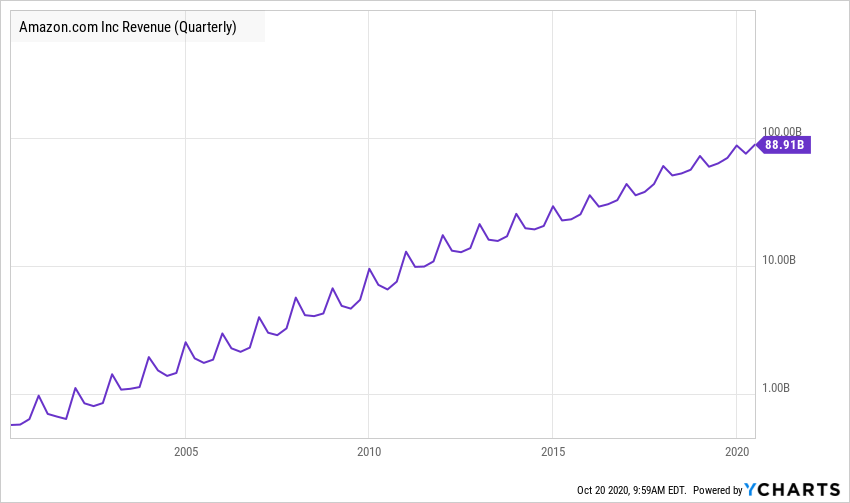

Amazon has experienced incredible growth for the last 20 years with only a few hiccups along the way. Their revenue has grown greater than 20% in 17 of the last 20 quarters.

The last time revenue failed to grow by double digits was back in 2001.

While the Covid economy has been a tailwind for Amazon, it’s also forced its competitors to play catch up.

Gavin Baker wrote an interesting piece on why traditional brick and mortar retailers are likely to be the biggest long-term Covid beneficiaries. He wrote

Wal-Mart’s digital revenue in Q2 was an annualized $42 billion, growing 94% — faster than Amazon. Best Buy’s digital revenue in Q2 was an annualized $19.4 billion, growing 242% — faster than Amazon…Perhaps the simplest way to express what has happened during Covid is to note that Amazon has actually lost share in e-commerce during Covid.

Josh and I got into Gavin’s thesis and much more on this week’s What Are Your Thoughts?

Subscribe to the channel, you’ll get a notification as the show is about to premiere each week.

Josh and I use YCharts when creating visuals for this show, as well as for many aspects of their business. What Are Your Thoughts viewers can get a 20% discount for YCharts by clicking here (new users only):