There are those who would have you believe that the bull market was easy. That it was manipulated. That it wasn’t earned, or some other nonsense. That couldn’t be farther from the truth. Have stocks had wonderful returns over the last few years? Yes. Was it easy to earn those returns? No.

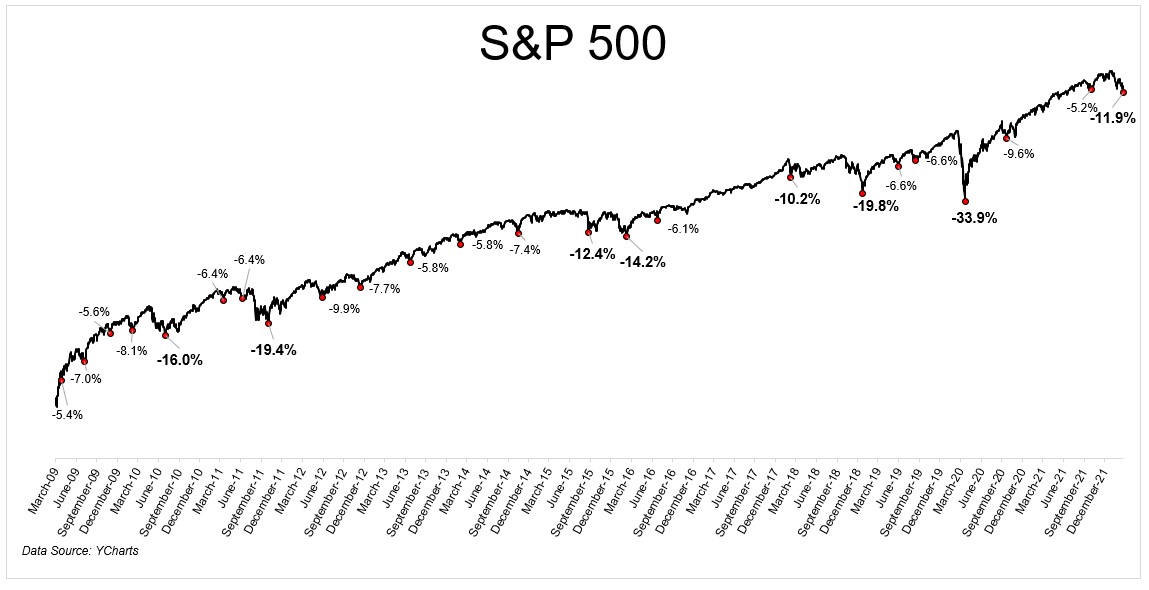

I don’t need to rehash every event on the chart below since they’re recent enough to be fresh memories. Living through this bull run, we’ve seen pullbacks morph into corrections and corrections mutate into bear markets. We’ve seen fear give way panic and optimisim turn into euphoria. Each of these numbers on the chart had a story attached to them, and the stories are what drive our decisions.

If you ever called yourself a long-term investor then there are two things you need to do; Buy, and hold. It’s the second part that trips people up.

Selling is an emotional blanket that provides temporary relief. It makes us feel better on the way down but leaves us paralyzed on the way up.

Let me walk you through a scenario of the “I’ll get back in when the dust settles” investor. They sell at 100 with the intention of buying back lower.

So fine, they sell at 100 and it goes to 95. “Phew, good thing I got out of there.” Mind you, stocks aren’t going down for no reason. There’s always a reason. Then 95 turns into 90 and 85. “Oh my god I was right. But things are bad and getting worse so I’m just gonna wait a little longer and see how this plays out.” At some point, whether it’s 80 or 75 or lower, stocks find a bottom but they do so in a way that doesn’t make intuitive sense.

What a lot of people don’t understand is that it’s not good news or bad news that drives markets, it’s the incremental change between bad and getting worse. Investors discount the news and at some point the market loses its ability to be shocked by more bad news. All of it was already absorbed. Which is how stocks can bottom when things seem most bleak. At some point everyone who sold sells, and so the market will stage a furious rally off the lows that will leave investors stunned. Say the market goes from 100 to a low of 75, and then it bounces to 85. The investor who felt great about getting out of the way at 100 thinks, “Well, I can’t buy now at 85 when just 3 days ago I could’ve bought for 75.” The same thing plays out at 90 and at breakeven, 100, the investor is kicking themselves. Now what?

Okay, that’s one way for this to play out. The other is an investor sells with the intention of buying back lower, only it never goes lower. They sell at 100 and the next day it’s 103 and 105 the day after. Now what? If buying back below where you sold is hard, then buying back higher is impossible.

If you never sell you never have to worry about when and how to get back in. True, but buying and holding with 100% of your portfolio isn’t realistic for most people. I get it. I’m not a buy and hold forever or else you’re an idiot type of guy. I understand the challenges of sitting through bear markets that don’t snap back after 30 days.

So I’m fine with systematically de-risking as volatility picks up and the range of outcomes widen. In fact, we run a model that attempts to do just that. But the important thing is that when you de-risk, you have to have a plan to get back in. It’s an absolute must. Because without rules all you have are emotions, and when fear and greed are steering the ship you’re going to hit an iceberg.

It might sound like I’m talking out of both sides of my mouth: “buy and hold but sometimes it’s okay to take a little off with a portion of your money so that the rest of your investments can sit tight.” Guilty as charged. I don’t believe in absolutes. The world isn’t black or white, and neither are your investments.

The bottom line is that whatever strategy you employ, you need to have a plan. Without a plan you’re never going to get to where you’re trying to go.