Today’s Animal Spirits is brought to you by Composer and Masterworks

See here for the new 60/40 portfolio by Composer

Go to Masterworks.io/animal to learn more about investing in contemporary art.

Go to Masterworks.io/animal to learn more about investing in contemporary art.

On today’s show we discuss:

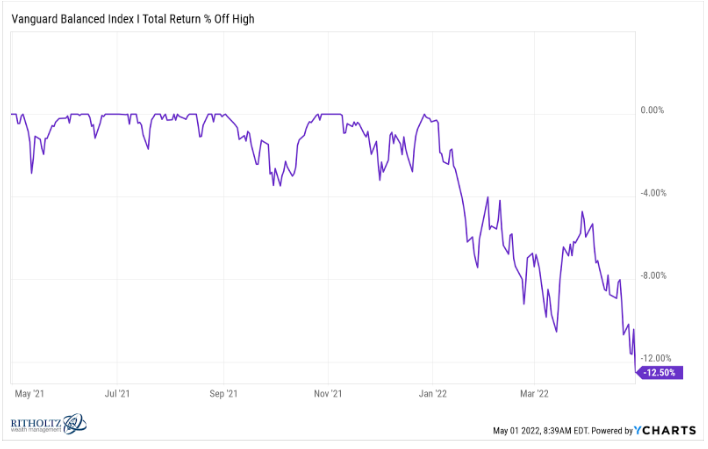

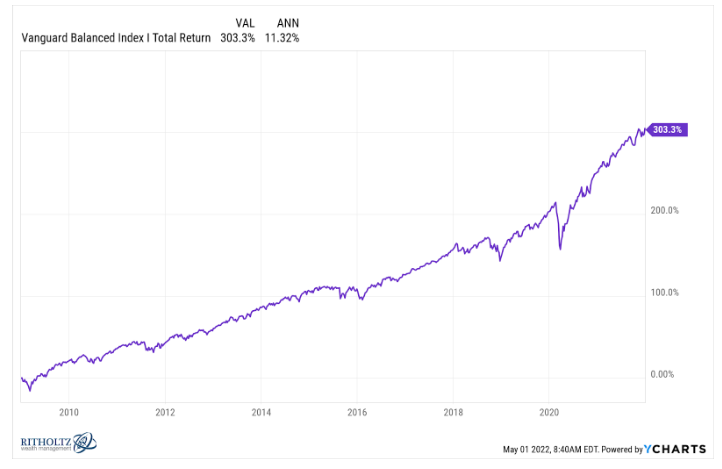

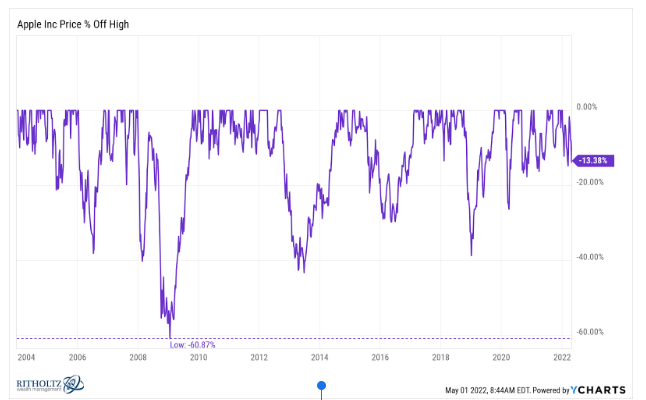

- This is an average drawdown

- More worried about the bond market than the stock market

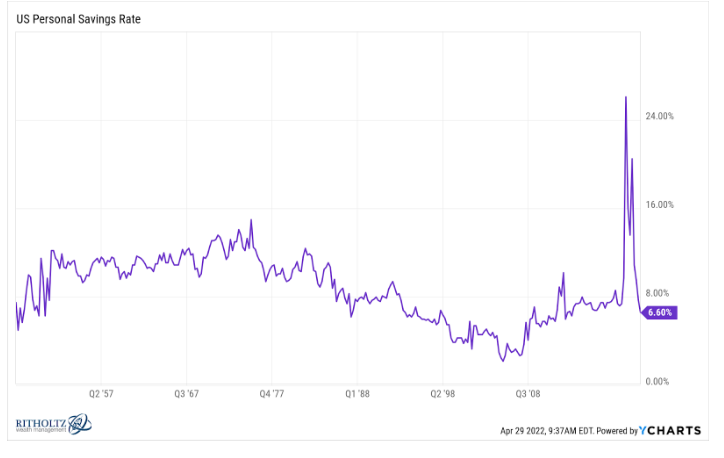

- Home equity created by the pandemic housing market

- Adjustable-rate mortgage demand hit’s highest demand since 2009

- Microsoft earnings

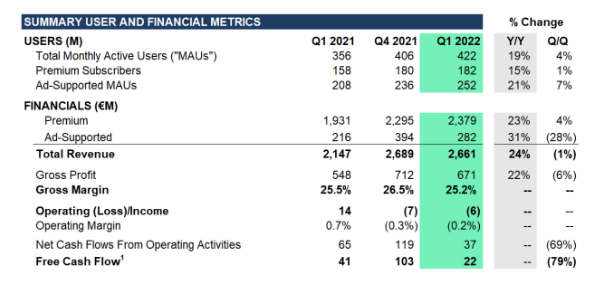

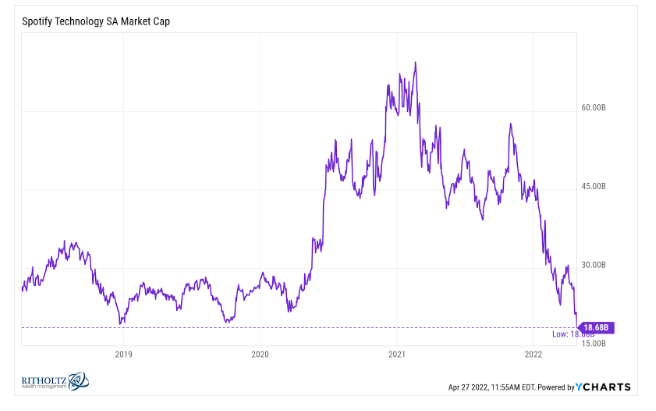

- Spotify earnings

- Chipotle earnings

- Amazon earnings

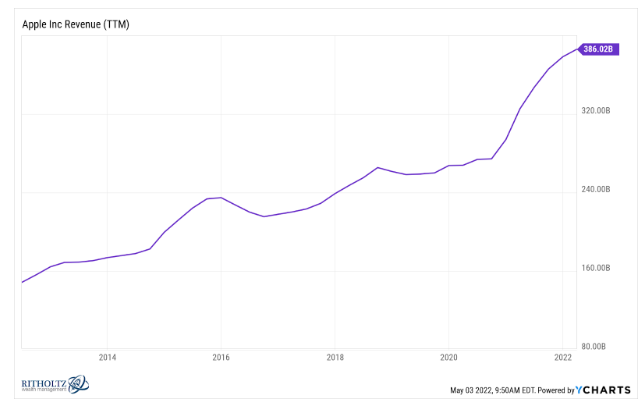

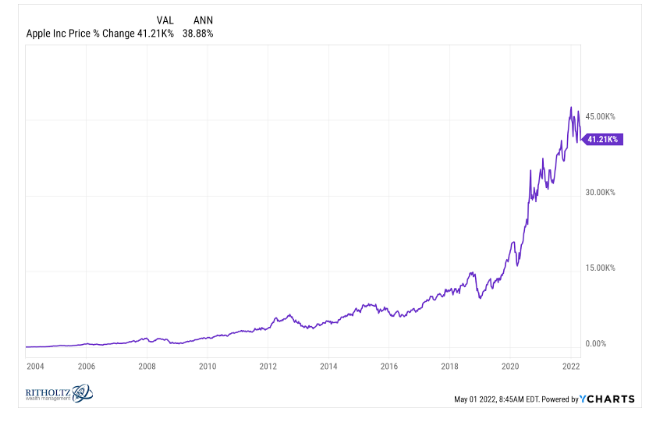

- Apple earnings

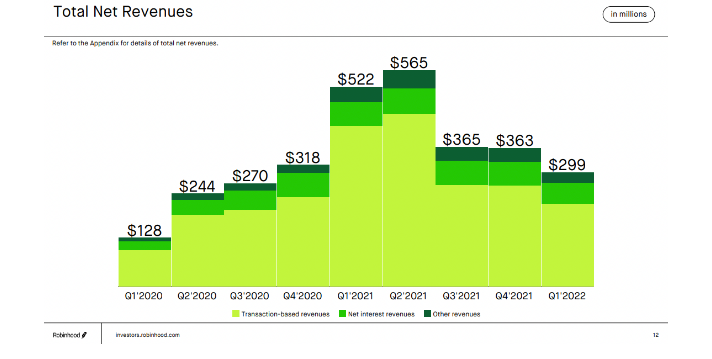

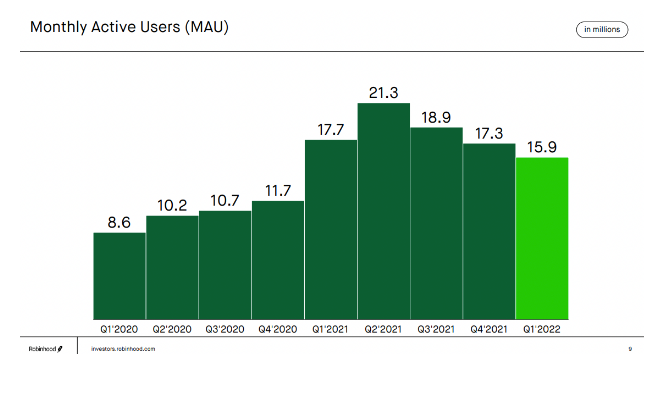

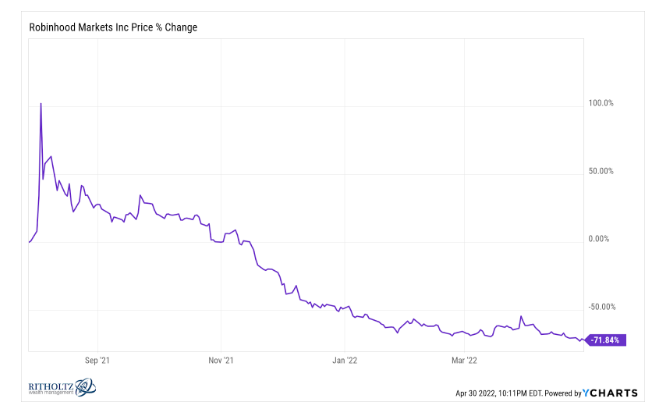

- Robinhood earnings

- Robinhood lays off 9% of its full-time employees

- My YCharts webinar

Animal Spirits NFTs:

- Animal Spirits Community NFT

- Reach out to Audiograph for support on Twitter or Discord

Listen here:

Transcript here:

Recommendations:

- The Bogle Effect By Eric Balchunas

- Suicide Kings

- Austin Powers on Rewatchables

- Better Call Saul

- Ozark

Charts:

Tweets:

Someone asked, and yes $ARKK is about to post fourth straight month of inflows in April for a sum total of nearly $1B ytd (top 3% among all ETFs) despite continued pain (down 47% ytd, 67% 1yr). That said, ARK's other ETFs offset this w/ about $1b in YTD outflows pic.twitter.com/s4N9kMJgAD

— Eric Balchunas (@EricBalchunas) April 28, 2022

I'm still trying to wrap my mind around the fact that $ARKK is down ~50% YTD but has pulled in $908 million in net new money.

Theories:

1.) Investors are doubling down

2.) Shares are being created to short

3.) Super-volatile ETFs will find a marketWhat am I missing? pic.twitter.com/t58JeE5ByR

— Ben Johnson, CFA (@MstarBenJohnson) April 28, 2022

But this is what makes $ARKK a unicorn: Assets *poured* in during the run-up and, remarkably, have largely stayed put since then, despite the brutal selloff. Take the two together, and it is maybe the biggest, fastest destruction of shareholder capital in fund history. pic.twitter.com/lnKv7M1hwC

— Jeffrey Ptak (@syouth1) April 28, 2022

Monthly returns….impressive https://t.co/CfXHPK2xq0 pic.twitter.com/A1Zxyghna5

— Danny Kirsch, CFA (@danny_kirsch) April 29, 2022

Tiger Global’s long-only fund was hit even worse, tumbling 25% last month and extending its drop for the year to 52%: BBG

An entire generation of traders has no idea what to do when Fed isn't bailing their ass out

— zerohedge (@zerohedge) May 3, 2022

Adjustable-rate mortgage demand doubles as interest rates hit the highest since 2009 https://t.co/7K1XlYcoRz

— Catherine Rampell (@crampell) April 27, 2022

Chart – @RickPalaciosJr

One of the reasons arm loans aren't that popular anymore is the debt structures, and the qualification process is much different. Still, it gives people an out because they're looking to refinance to a 30-year fix later. pic.twitter.com/KbtAB4OR7G— Logan Mohtashami (@LoganMohtashami) April 27, 2022

AWS is running at a $74 billion annual run rate.

For comparison, this is the TTM revenue for:

General Electric: $74 billion

Disney: $73 billion

Tesla: $62 billion

Goldman: $53 billion

Nike: $47 billion

Coca-cola: $40 billion

Netflix: $30 billion

Starbucks: $30 billion— Michael Batnick (@michaelbatnick) May 2, 2022

https://twitter.com/waltmossberg/status/1520059143243157504?s=21&t=uF47cr6VKham8HzMB271bQ

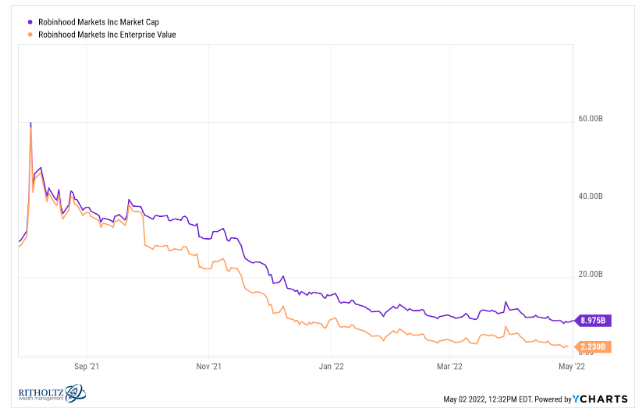

Robinhood was valued at 12 billion in private market. Now at <9 billion. Coinbase was at 68 billion. Now at 28 billion. SoFi went public at ~9 billion. Now at 5 billion. Root was valued at ~4 billion in private market. Now at <0.5 bil

Maybe its time to revisit this fintech thing

— Sar Haribhakti (@sarthakgh) April 27, 2022

Looks like Pinterest share price is below the Series G and Series H rounds, which were funded in 2015 and 2017. Also broke the IPO price from 2019. Pretty wild.

— modest proposal (@modestproposal1) April 27, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: