Warren Buffett began his investment partnership in 1957 at 25 years old. He started with $105,100 and seven limited partners; his mother, sister, aunt, father-in-law, brother-in-law, college roommate and lawyer. He charged no management fee, took 25% percent of any gains beyond a cumulative 6%, and agreed to personally absorb a percentage of any losses.

And he did it with integrity:

“I have over 90% of my personal net worth in BPL, and most of my family have percentages in that area, but of course, that only demonstrates the sincerity of my view- not the validity of it.”

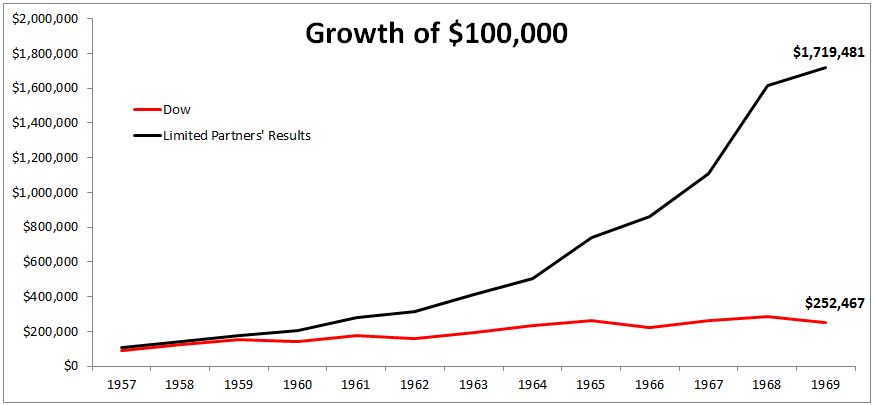

His view would prove valid, as the LPs compounded their money at 24.46%, net of fees (29.5% before fees). The annual return of the Dow over the same time, including dividends, was 7.38%.

But as time went by, he was finding a dearth of opportunities. The go-go era ushered in a new world of high turnover and quick profits. And as investors began to focus more and more on short-term performance, Buffett announced that he was not accepting any new partners. He took his goal of outperforming the Dow by 10% per annum down to 5% and warned his investors that he didn’t think he’d be able to earn more than 9% in any given year. And finally, in May 1969, with too much cash and not enough ideas, he told his LPs he would be closing the fund.

Buffett’s performance is so off the charts that it’s easy to overlook how effective he is at communicating his thoughts and investing principles. He started blogging almost sixty years ago via typewriter.

Here is Buffett in January 1967 warning his LPs to curb their enthusiasm.

The results of the first ten years have absolutely no chance of being duplicated or even remotely approximated during the next decade.

In October 1967, he explains how the game has changed.

Such statistical bargains have tended to disappear over the years……..When the game is no longer being played your way, it is only human to say the new approach is all wrong, bound to lead to trouble, etc. I have been scornful of such behavior by others in the past. I have also seen the penalties incurred by those who evaluate conditions as they were- not as they are. Essentially I am out of step with present conditions. On one point, however, I am clear. I will not abandon a previous approach whose logic I understand (although I find it difficult to apply) even though it may mean foregoing large and apparently easy profits to embrace an approach which I don’t fully understand, I have not practiced successfully and which, possibly, could lead to substantial permanent loss of capital.

In July, 1968, Buffett is basically like, I know I told you to expect low returns, but ¯\_(ツ)_/¯

At the beginning of 1968, I felt prospects for BPL performance looked poorer than at any time in our history….We established a new mark at plus 58.8% versus an overall plus 7.7% for the Dow, including dividends which would have been received through the ownership of the Average throughout the year. This result should be treated as a freak like picking up thirteen spades in a bridge game.

The world would be a better place if more people had this much integrity. From May, 1969.

Quite frankly, in spite of any factors set forth on the earlier pages, I would continue to operate the Partnership in 1970, or even 1971, if I had some really first class ideas. Not because I want to, but simply because I would so much rather end with a good year than a poor one. However, I just don’t see anything available that gives any reasonable hope of delivering such a good year and I have no desire to grope around, hoping to “get lucky” with other people’s money. I am not attuned to this market environment and I don’t want to spoil a decent record by trying to play a game I don’t understand just so I can go out a hero.

In October 1969, Buffett shuts it down, but not before recommending his clients invest with his Columbia classmate and future legend, Bill Ruane.

I feel it would be totally unfair for me to assume a passive position and deliver you to the most persuasive salesman who happened to contact you early in 1970.

When he closed the fund, Buffett paid his partners in Berkshire stock, which is trading today at $212,630, a 2,797,633% increase since his first purchase in 1965. Before closing down, he wrote his partners a ten page letter detailing why he recommended tax-free municipal bonds (not a bad call, he missed the collapse of the nifty-fifty stocks). He even offered to sit down with each of them individually to explain the rationale, as well as make the actual purchases for them. But for those who wished to continue to invest in stocks, he recommended a future legendary investor, Bill Ruane, whose Sequoia Fund returned 289.6% over the next decade, versus 105.1% for the S&P 500. For all of these reasons, even though Buffett called it quits after his worst year ever, he still went out on top.

This post was inspired by Jeremy Miller’s excellent Warren Buffett’s Ground Rules.

Source: