Today’s Compound and Friends is brought to you by Masterworks:

See here for important disclosures*

On today’s show we discuss:

- The S&P hasn’t made this many daily U-turns since 2008

- Market reaction to Octobers CPI print

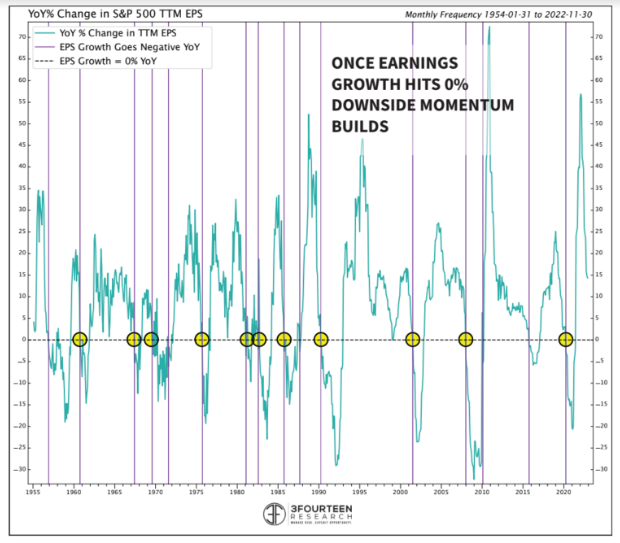

- Earnings moving forward

- What future CPI prints may have in store for us

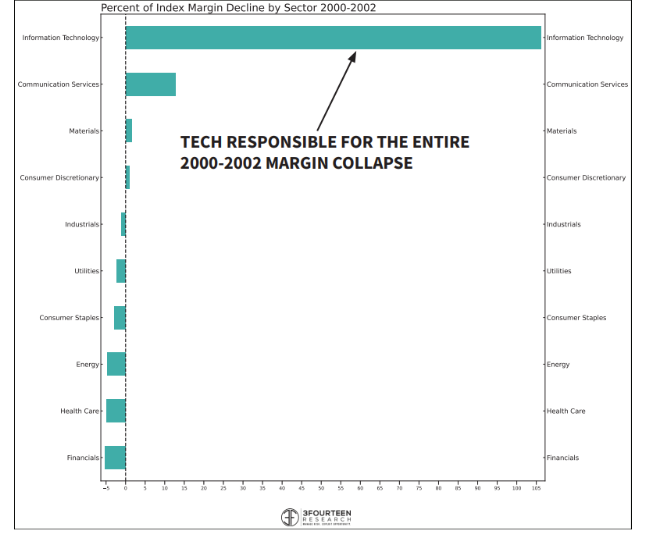

- Sector rotation

Listen here:

Warren Pies:

Charts:

Tweets:

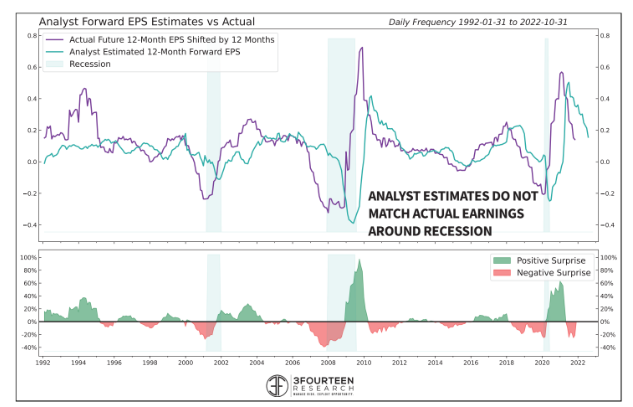

Drop in S&P 500 blended forward 12m EPS not yet anywhere close to recessionary pic.twitter.com/QiwFtN2spe

— Liz Ann Sonders (@LizAnnSonders) November 9, 2022

Equity put/call ratio spiked yesterday to highest since March 2008 … magnitude surpassed March 2020 spike by narrow degree pic.twitter.com/JVe4Z1GnKC

— Liz Ann Sonders (@LizAnnSonders) November 9, 2022

Contact us at askthecompoundshow@gmail.com with any feedback, recommendations, or questions.

Follow us on Instagram and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

*”Net Returns” refers to the annualized rate of return net of all fees and costs, calculated from the closing date to the sale date. IRR may not be indicative of paintings not yet sold, past performance is not indicative of future results.

**Wealthcast Media, an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. To learn more about the risks investing in Masterworks, see https://www.masterworks.com/about/disclaimer . For additional advertisement disclaimers see here https://ritholtzwealth.com/advertising-disclaimers/