I was thinking about the role luck plays in success today while listening to Danny Meyer with Tim Ferris. Meyer was talking about all of the different things that had to happen to get him to where he is today. One of the funny things about life is you never know which moment in time will shape the rest of your journey. A chance meeting here or a missed train there can change everything forever.

People love to talk about their bad luck. “Watch. As soon as I buy this stock, it will go down.” Or, “Just my luck. I bet on the Bulls to win by five and they won by four.”

Things like this might fun to talk about, or I guess complain about, but they’re trivial. They don’t move your needle of life.

While almost nobody has trivial luck, almost every successful person I’ve ever met has been lucky when the stakes were high. Not lucky in the sense that their success wasn’t earned, but just fortunate that they were in the right place at the right time, and usually several times.

I feel like the luckiest guy in the world. Relative to where life could have taken me, I hit the lottery. I didn’t take my education seriously. I got kicked out of college twice. I had no resume to speak of.

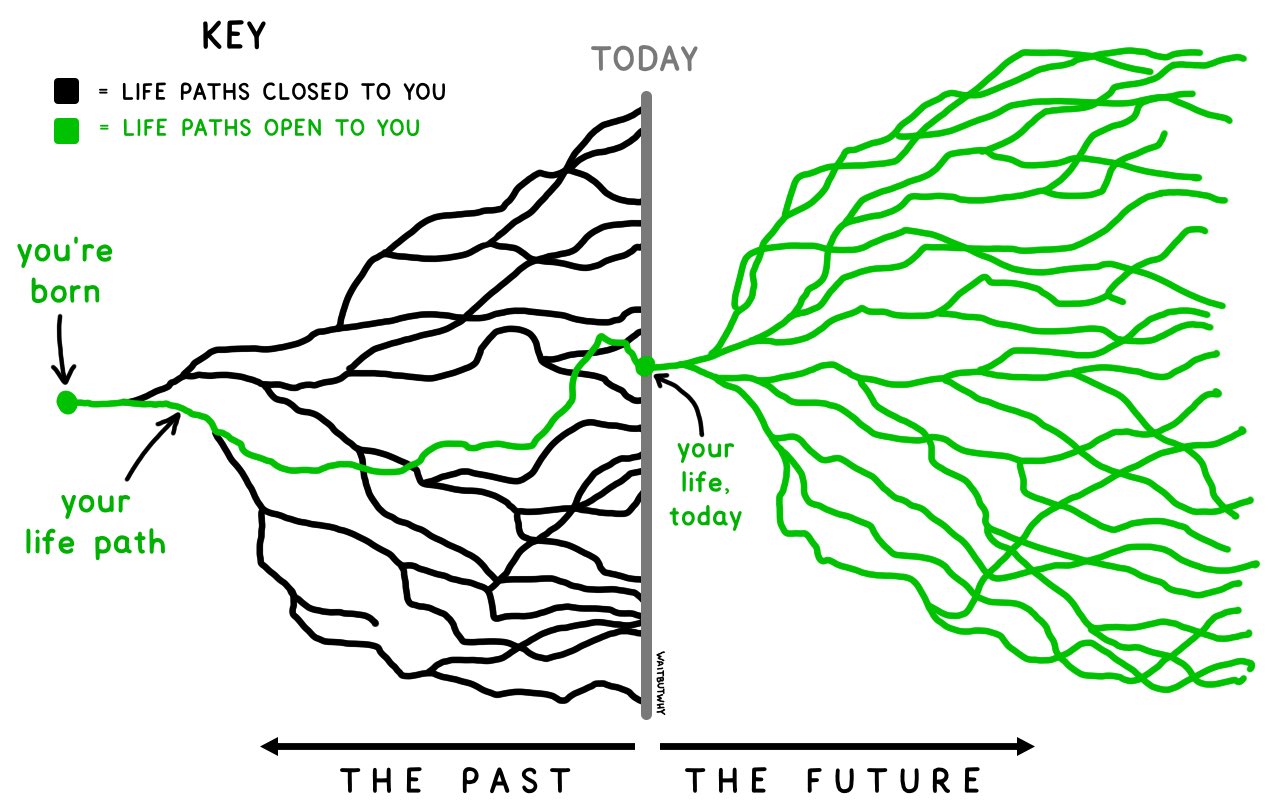

I always had internal confidence, but externally I was and still am self-conscious. I needed somebody to take a chance on me, but I never was able to convince anyone I was worth taking a chance on. Until I met Josh. I’ve told that story many times before, so I won’t rehash it here, but I’ll share some other crazy stories that ultimately led me to where I am today. I am a great example of this fantastic image below.

When I finally graduated college, a year and a half late, the financial system was experiencing a full-blown meltdown. People with incredible pedigrees were out of work. What chance did I have? I got a job at one of the few places that would hire anyone with a pulse. An insurance agency. Trying to sell a product people don’t want to people who don’t know you is a hell of a way to develop a thick skin. Thirty rejections a day for a year left me with some pretty serious battle scars.

I was lost. I mean, really lost. 23 years old, no income, no prospects, nothing. I couldn’t sleep. My eyelid was twitching for months because of the stress. It didn’t help that my mother was slowly dying. I was in a bad place.

And then one day I got an email that would change my life. I didn’t know it at the time, but that’s how this thing works. You never know which line is going to lead to the next line that eventually leads you on the path you were looking for but couldn’t find.

My father knew someone who was an advisor at Wells Fargo. The gentleman agreed to meet and took a liking to me. From there, every day he would send me notes from David Rosenberg, Jeremy Grantham, Jeff Saut, and John Hussman. These were the guys you read in the crisis and I owe all of them a ton of gratitude. They planted the bug. I didn’t know anything about economics or the market or behavioral finance or any of that stuff. They got me hooked.

This advisor would send me emails every day and I read them all. Eventually, I left the insurance company to go all in on this. My job was to learn as much as I could, sit for the CFA, and somehow someway find my way into the industry.

Here’s an email I sent to him in 2010:

The Grantham piece was excellent, thank you for sending. July will be my last month at the insurance agency, I am miserable. There is no salary and my rent to work there (yes rent) is just becoming unaffordable. I am going to try and get temp finance work in the meantime, will keep you posted.

On Monday I had lunch with a hedge fund guy who was nice enough to meet with me through a connection. He gave me some valuable advice, and told me that once I really narrow in on exactly what it is I want to do, he would meet with me again and try to make 1 or 2 introductions. I am also still waiting to hear back from my sister’s friend at Oppenheimer. I am exhausting all possible connections, and my father is also doing the best he can to introduce me to some people as well. It sure is funny how life works out, I can say without a doubt that meeting with you has changed my life, and I know I will have a successful career. By sharing so much with me, I have found a passion that I am very excited about. I will let you know what transpires. Thanks for everything.

So I left without a plan other than an irrational belief in myself that everything would work out. Little did I know that it would be a while before anything transpired.

The financial industry was frozen, given that the sector was at the epicenter of the great financial crisis. The job market was so bad that I considered moving to San Antonio to take a role as an internal wholesaler at a company I never heard of. And then one day I got an opportunity

A friend of mine at the insurance agency introduced me to a buddy of his who worked at eTrade on Long Island as a branch manager. I interviewed with him and finally, I found somebody who was willing to take a chance on me. I’ll never forget when I got the call. I remember exactly where I was and how I felt. I’m pretty sure I cried. After drowning for the better part of a year, somebody threw me a lifeboat. And as a bonus, the pay was great. I think in the neighborhood of $65,000 for an entry-ish-level job. And then the bottom fell out.

I got a call one afternoon with some not-so-good news. They told me there was a ding on my credit report that they were looking into. I had never missed a payment on anything so I had no idea what the issue could be. They told me it was for an apartment in Indiana. What?!?!

I got kicked out of Indiana University after my freshman year for bad grades. To make a bad situation worse, I had already signed a lease for my sophomore year, so I had to get a full-time job as a waiter to make the $400 monthly rent payment. What I didn’t know, until eTrade told me, was that one of my roommates trashed the apartment and never paid for the damages. I guess the building sent them a bunch of notices but since I was hundreds of miles away, I didn’t know about it.

While I was trying to explain to the hiring manager at eTrade what happened, the guy who hired me left for a position at another company. And the new guy took one look at my resume, and said, yeah, pass. Not getting this job crushed me at the time, but it ended up being a blessing in disguise. Had I taken that role, who knows where I would be today?

This is one of a hundred things that happened to me which led me on the path to meeting Josh at the train station on a Friday night after Mario Chalmers hit a three to put the heat up by 18 points in a playoff game where before I sat down I got an email from my last job opportunity saying that I was shit out of luck. If I don’t get that email, if Mario Chalmers misses that shot, I stay at the game and never work for Ritholtz Wealth Management and very likely don’t have the career that I do.

Now, when I did meet Josh, I was ready. I put in the work and showed him how hungry I was and why he should take a chance on me. Luck is when preparation meets opportunity, as the saying goes. My point is, a million different things had to happen to get me to that very moment in time.

Your life is the roll of a hundred dice each with a dozen numbers. Some people catch a few lucky breaks, as I did, and others crap out. It’s uncomfortable to think about how random your circumstances can be, but if you have a positive attitude and you work hard, you give yourself a better chance at getting lucky in life.