How many millions of American investors asked themselves the same question heading into 2023? “Why would I own stocks when I can get close to 5% risk-free* in 1-year treasury bonds?”

It was and is a reasonable question. In a vacuum, bonds are competition for stocks. But the reason why bonds are now a viable alternative is because there’s a lot to worry about. And when that’s the case, a guaranteed 5% sounds a lot better than the potential downside of holding risky stocks.

Coming into 2023, inflation had been running above 6% for fifteen consecutive months. The fed was aggressively hiking interest rates in an attempt to slow the economy and cool inflation. Like the fed, tech companies were acting aggressively to shave expenses as wall street became laser-focused on the bottom line. The IPO market was frozen. Housing was heading for a clear slowdown. And then came the regional bank debacle. And then the debt ceiling. Safe assets sure looked like the right decision in January.

And yet here we are, halfway through the year with the S&P 500 up 10%. The Nasdaq-100 is up 31%, one of the best first half of a year ever.

“But the market is being driven by just five stocks!!”

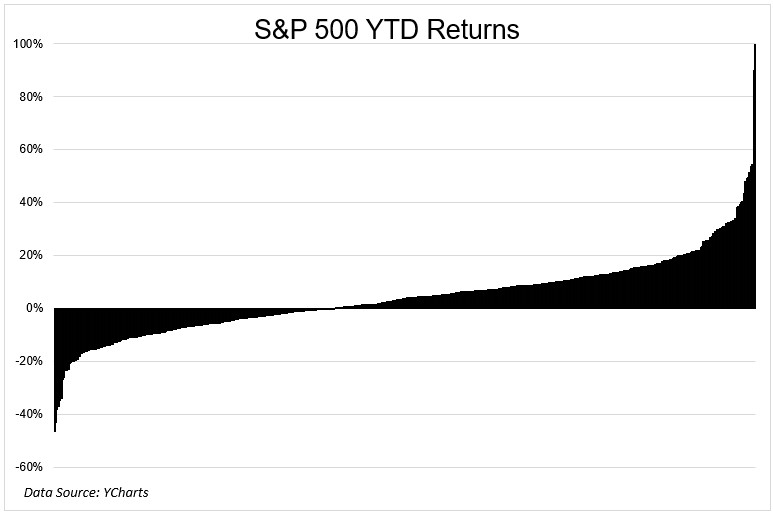

Well, yes, the S&P 500 ex the mega-cap stocks is a bit of a mixed bag. 200 stocks are down on the year, and 300 are up. **

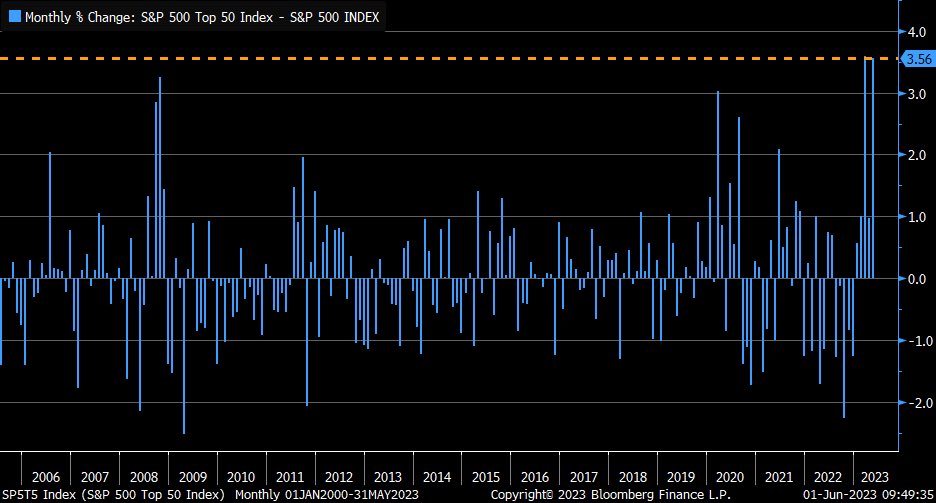

While it doesn’t seem so crazy when framed this way, it’s a fact that all of the gains this year have been in the giant stocks, especially recently. In May, the top 50 stocks in the S&P 500 outperformed the other 450 by the widest margin since at least 2005.

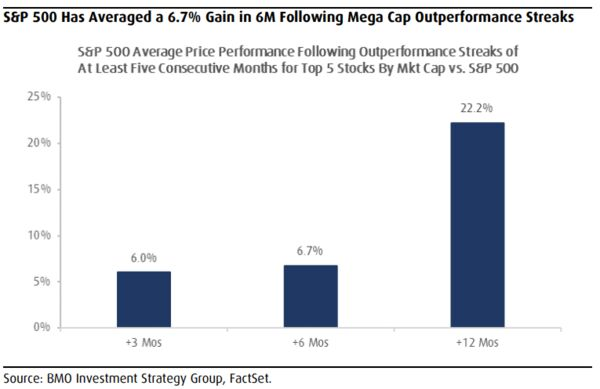

The big worry now is that when the mega caps run out of steam, they’re going to drag the rest of the market down with it. But that’s not what history says.

This chart from BMO shows what happens when the top five stocks carry the rest of the market. Up 22% twelve months later on average. Not so bad.

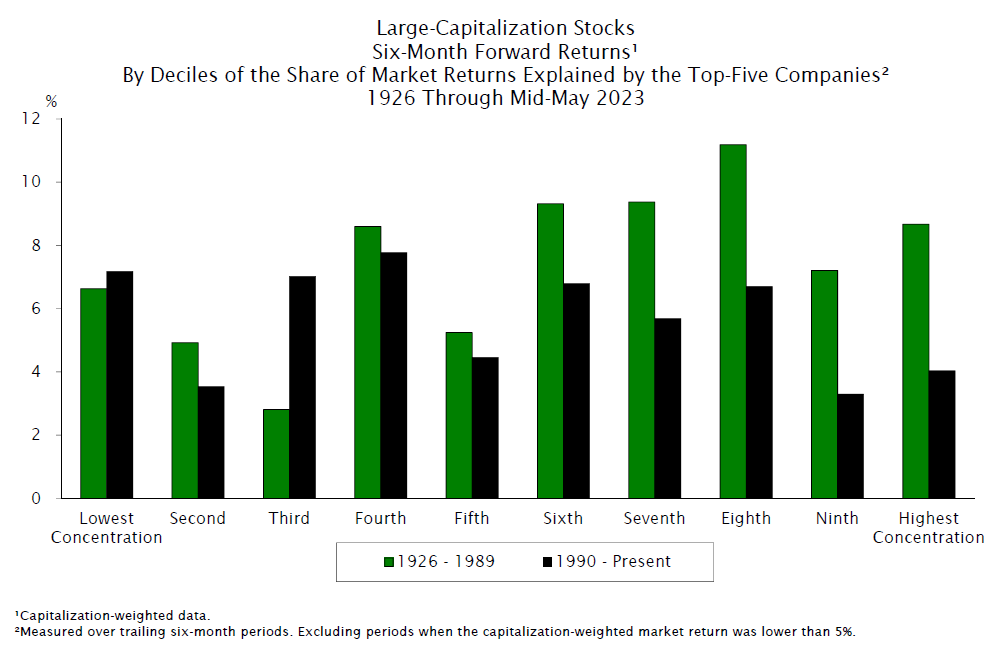

Here’s another great chart showing the impact concentration has on forward returns. Sure, broad participation has led to better forward returns, but high concentration hasn’t exactly been a harbinger of doom either.

I am not making any predictions on how the year ends. Maybe we give back all the gains. Who knows? But there is an important point to be made getting back to eschewing risk when safety feels comfortable; protecting yourself when things feel dangerous is almost never the right decision, at least not in the stock market.

*nominal, reinvestment risk, etc.

** This was as of a week ago