“The fed is punishing savers.”

For years after the Great Financial Crisis, our central bankers made the collective decision to keep interest rates at zero. This “forced” people out on the risk curve. See, if you were used to getting a positive real yield on your fixed income, and then that income all but disappears, you’re going to change your mix of stocks, bonds, and cash. This actually worked out well for people who took the nudge, but that’s another story for another day.

The last decade can be summed up by four words; “There is no alternative.” Those four words are dead and buried, with 80% of all fixed income now yielding more than 4%. I was thinking about this while listening to BlackRock’s latest earnings call. Their President, Robert Kapito, was asked about money going into bonds. Here’s his response:

Currently yields are back, but I think in general, most people think that yields are going to continue to rise. So they are preparing for, what I would call, a generational change in the fixed income market. Because you can actually earn attractive yields without taking much duration or credit risk. And if you go back clients shifted towards illiquid investments over the last decade to get those returns, but while there is still demand for the private markets to diversify and pursue outperformance, investors as you know, can get most of that yield and their liabilities and meet them through bonds and we are so well-positioned for that both with our $3.4 trillion fixed income and cash platform. So to give you some numbers, 80% of all fixed income is now yielding over 4%. This is a pretty remarkable shift in our history. We’re calling this a once-in-a-generation opportunity. There is finally income to be earned in the fixed-income market and we are expecting a resurgence in demand.

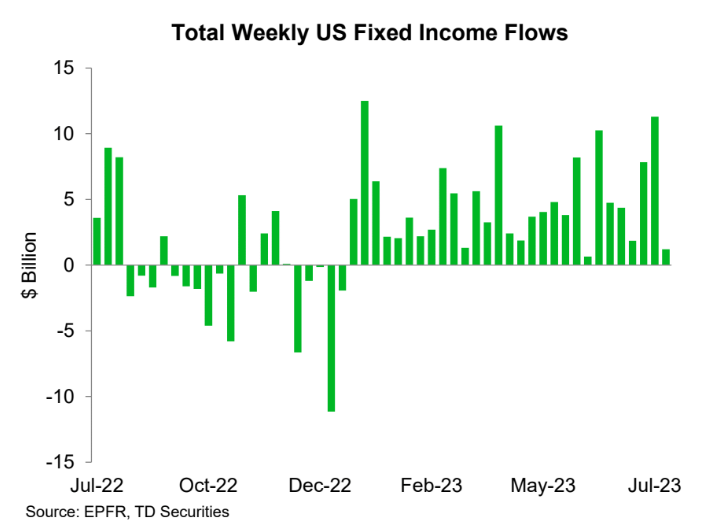

Investors are rightly taking advantage of the current rate environment. This is from The Daily Chartbook via TD Ameritrade

“Global bonds saw their 17th consecutive week of inflows, reaching a total of $1.4bn for the week to July 19th…primarily driven by $1.2bn inflows into the US market.”

Nobody knows how long this yield-rich environment is going to last, but as I type this, the rate on the 30-year bond is breaking out to the highest level since last November.

People view bonds as competition for stocks as a bad thing. But it’s not.

Let’s say bonds were yielding 2%. If stocks earned 10%, that would be a 6.8% return for a 60/40 portfolio. With bonds yielding ~5%, stocks would only need to earn 8% to get that same 6.8%. Whether or not stocks can do that going forward is not my point. I’m just saying that it’s a push and pull, and I’ll take higher returns on bonds and lower returns on stocks any day of the week.

There’s been a sea-change in the investing landscape, and investors are paying attention.