The events over the weekend are horrifying. We here in the United States are blessed to live in a country that is insulated from having to worry about the unthinkable nightmares that we see too often around the world. We’re blessed to live in a country where our safety and that of our loved ones are not always in the back of our minds. I can’t make sense of what’s happening in Israel, but hopefully I can help put the atrocities into context when considering the market implications.

The words that follow felt callous to write, but part of my job is to worry about the market, so here are some thoughts on how to think about a brighter future when today is pitch black.

One of my foundational beliefs when it comes to investing is that even if you knew what was going to happen tomorrow, you wouldn’t necessarily know how to make money.

Today was a perfect encapsulation of that tenet. Bespoke tweeted:

If someone told you last Tuesday that Friday’s Non-Farm Payrolls would top forecasts by more than 150K and then over the weekend Israel and Hamas would be at war, you definitely would have said that the S&P 500 would rally over 2% and crude oil would fall 3%. Right?

It’s mostly a fool’s errand to try and derive meaning of why the market did what it did on any given day and why, but here’s my best shot at it. People buy treasuries when there is a geopolitical crisis., and that’s just what happened today. Bonds (AGG) gained 1% today for the first time since March. The relief in yields sparked some relief in the stock market.

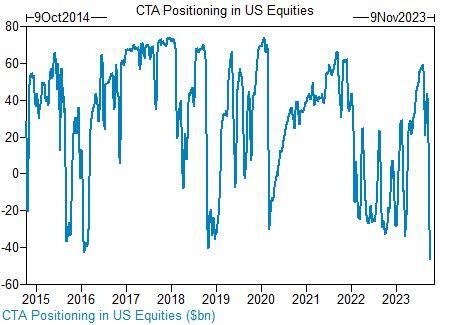

And when stocks didn’t fall, traders had to react. $40 billion worth of U.S. equities, the largest number since 2018. I’m guessing some of that was unwound today. And by guessing, I mean that this is pure speculation on my end. I have no evidence to support that statement.

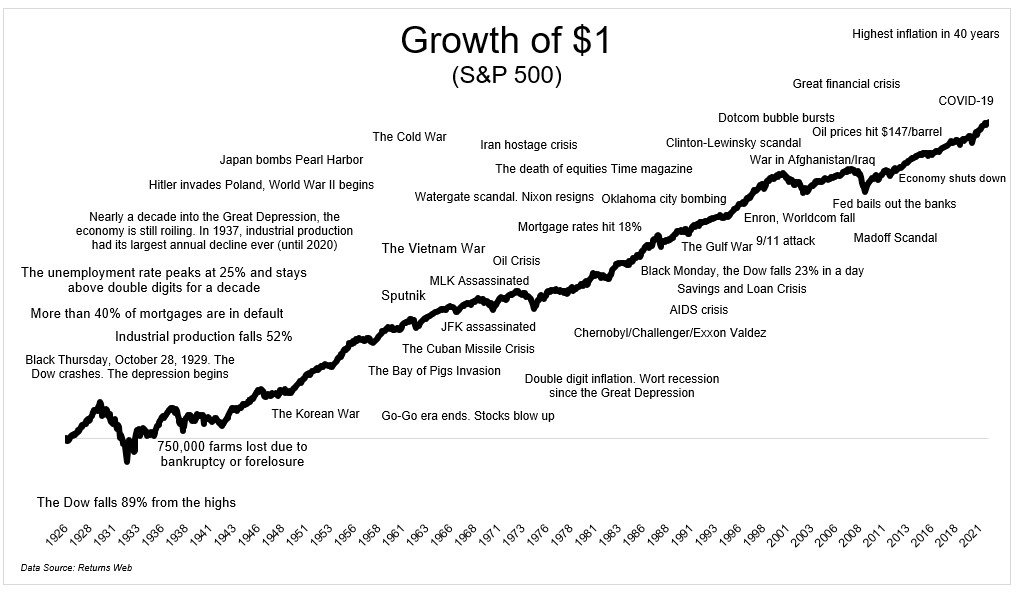

Unfortunately, history is one tragedy after another. And yet the market has rewarded investors who have been able to separate their money from their emotions. War and terror does not stop the world from moving forward.

This chart is a bit dated but its essence is timeless.

These events are a reminder of what matters. It’s hard to think about the market on days like this. It feels so trivial, and the reality is that it is. We’re blessed that our portfolios are a source of anxiety as opposed to things that threaten our very existence. I’ll end this with wise words from my partner Josh Brown, who wrote this today:

“Put portfolio concerns aside today and focus instead on your loved ones. Give them as many hugs and kisses and kind words as you can. It’s a much better use of your time.”