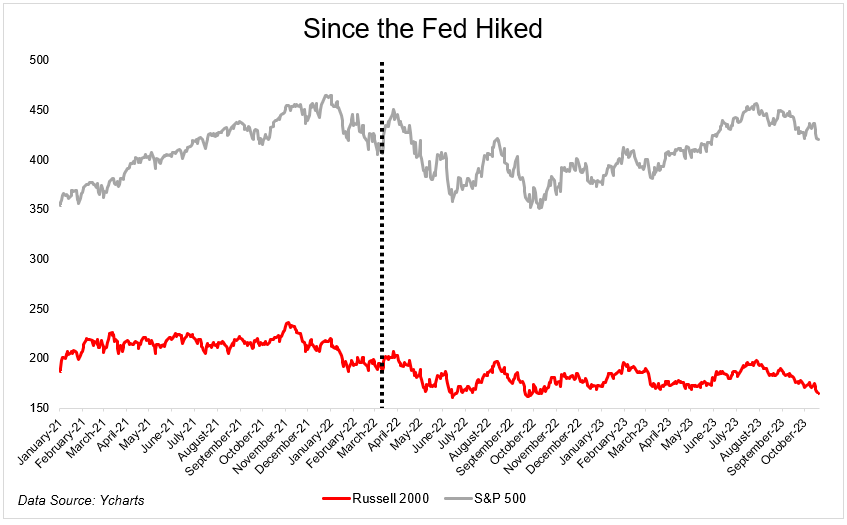

The S&P 500 is flat since the Fed started raising rates in March 2022. It’s weathered the hiking cycle much better than smaller stocks that are more sensitive to tighter financial conditions. Over the same time, the Russell 2000 is down 16%.

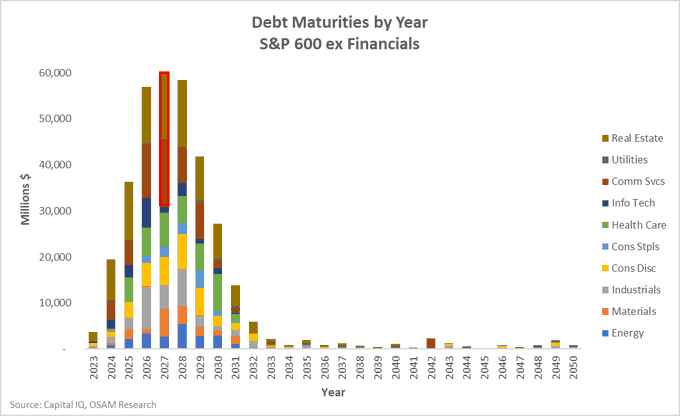

On last week’s What Are Your Thoughts? I shared this chart from Bank of America comparing long-term debt maturities of small versus large-cap indices. Surely this has been weighing on the Russell 2000.

Ehren Stanhope wrote a great thread that puts the chart above into some much-needed context. Nearly half of the debt in the Russell that is maturing over the next few years is in two sectors; real estate and communication services.

Everybody knows the story in real estate, not a huge surprise there. And in the other sector, according to Ehren, “the Comm Svcs part is mostly driven by 2 firms, fallen angels Dish and Lumen Technologies (formerly Centurylink) that have well-telegraphed issues with their balance sheets for quite some time.”

I don’t think Ehren’s thread changes the fact that higher costs of capital have been a massive headwind for smaller companies. But this is nevertheless an important reminder that we have to stay vigilant in the face of seemingly objective data. Facts can be misleading. Data can be wrapped in opinions and twisted into agendas.

Josh and I are going to talk about this and much more on tonight’s episode.