Today’s episode of the Compound and Friends is brought to you by Simplify:

See here for more information on Simplify’s income and diversification-focused strategies

On today’s show, we discuss:

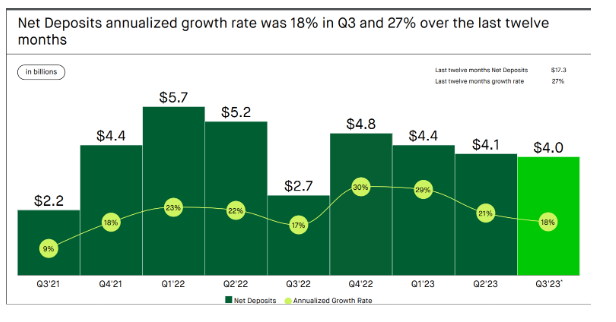

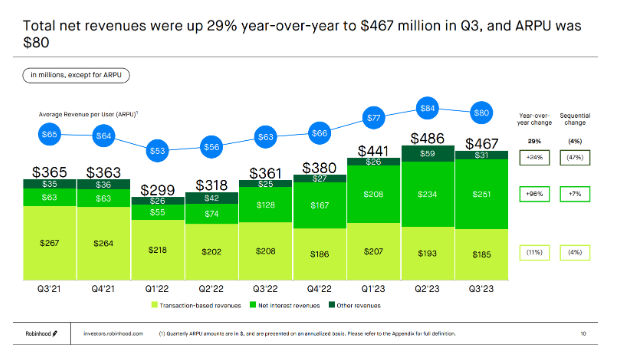

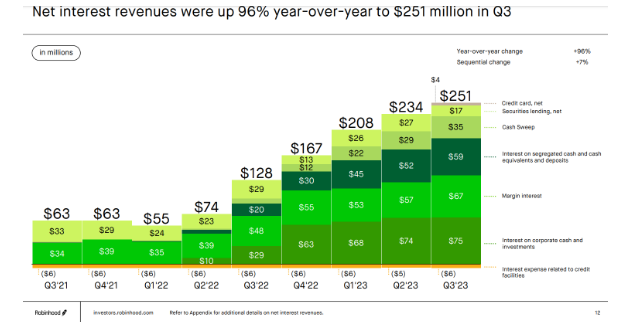

- Robinhood drops 14% after reporting big declines in trading volume and revenue

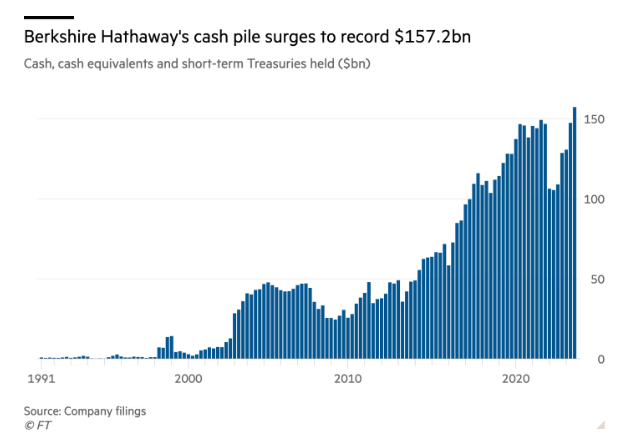

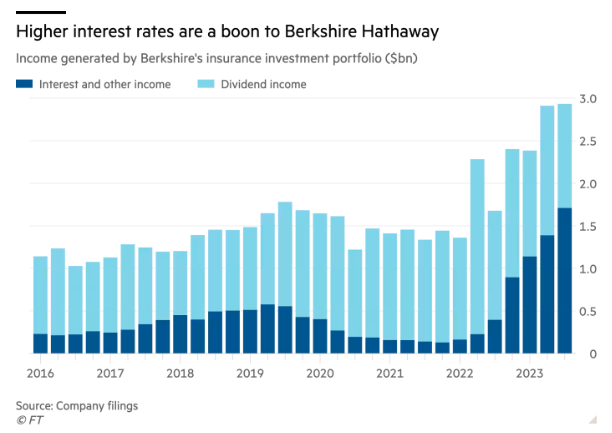

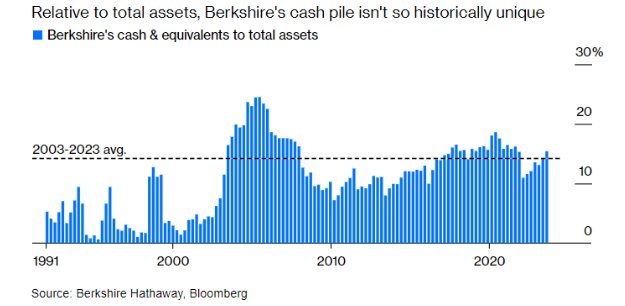

- Warren Buffets Berkshire Hathaway sells stocks as cash pile swells to record levels

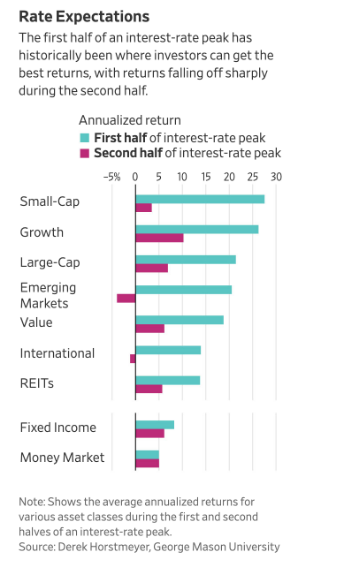

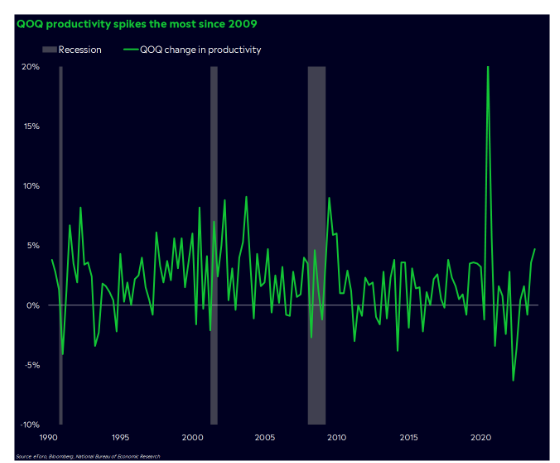

- If interest rates are peaking, what investments are likely to do best?

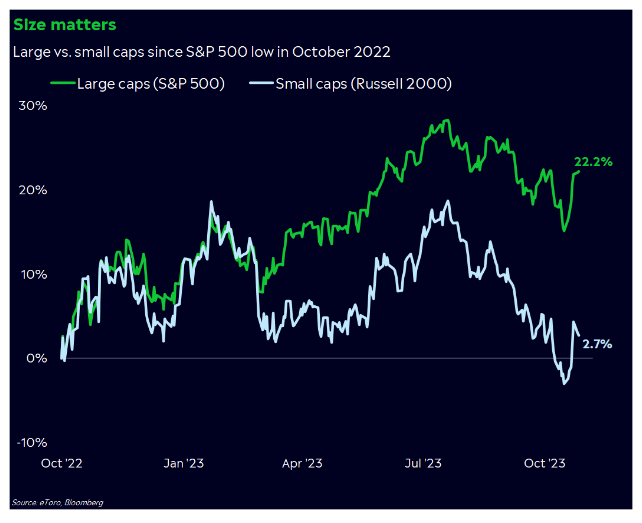

- Lopsided stock rally blurs lines of S&P 500 membership

- Why the weight-loss drug hype looks overdone

- Fast food outlets are going to be hurt in areas where Ozempic and Wegovy are heavily used, but the selloff in candy and beer stocks is somewhat overdone

Listen here:

Charts:

Recommendations:

- The Fund

- Tiny Beautiful Things by Cheryl Strayed

- Same As Ever by Morgan Housel

- The Wire

- 10x is Easier than 2x by Benjamin Hardy and Dan Sullivan

Callie Cox:

Malcolm Ethridge

Contact us at askthecompoundshow@gmail.com with any feedback, recommendations, or questions.

Follow us on Instagram and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.