“It’s hard to hold onto stocks for a long period of time.”

Carl Kawaja said this in an excellent conversation with Patrick O’Shaughnessy.

This made me decide to revisit a post I did a few years back, Looking For the Next Amazon.

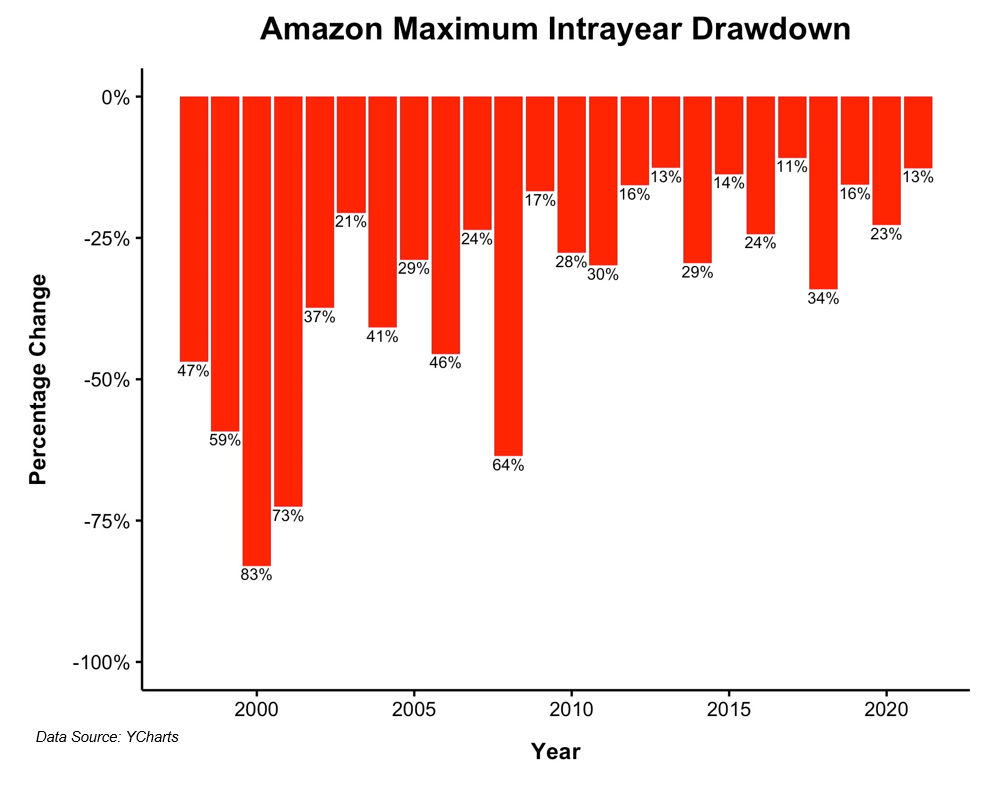

Amazon is one of the best-performing stocks ever, but it hasn’t been the easiest stock to hold over the last year. It’s up 6%, while the Nasdaq-100 is up almost 40%. With the broader market at all-time highs, this one sits in an 11% drawdown.

“Zoom out.” Fine, fair enough. Amazon is up 340% over the last 5 years and 1490% over the last ten years. But if you think this was an easy journey, think again.

The average intrayear decline for Amazon is 33%. Even if you take away the dot-com bubble, so after 2001, the average decline is 26.5%. Investors were rewarded for this risk, but each one of these drawdowns was enough to test their endurance.

It’s hard to hold stocks when they fall because it almost always happens for a reason. And even if there is no “news,” we make up a story. And then we wonder how far it can fall. And if we should have sold at the top. Stocks can fall for any number of reasons. Here’s a list of 10. There are way more.

- A recession. Nothing was spared from annihilation in the GFC

- An earnings miss. Investors have certain expectations. Miss em, and you’re toast.

- Competition. Look what happened to Costco the day Amazon announced they were acquiring Whole Foods. (Look what’s happened since)

- Style. If investors sour on your industry, it might not matter how well your business is performing. If investors pigeonhole you into a style, value, for example, and that style is out of favor, there’s not much you can do.

- Macroeconomic factors. A company that generates a lot of its sales overseas will get hit if the dollar strengthens.

- Microeconomic forces. Styles go in and out of fashion. Crocs are cool again. They weren’t always. Check out the chart from 2019.

- Black swan events. If you owned and operated malls, the pandemic destroyed your business. There is nothing to prepare you for moments like this.

- Technology/innovation: IBM. Barnes & Noble. RadioShack. Research in Motion. The graveyard of companies that were killed by progress is always growing.

- Everything gets crushed. Almost all of the best-performing stocks get killed from time to time. It usually happens because expectations rise far above what the company can reasonably deliver. No pain, no gain.

- Other. Sometimes stocks just go down because they can’t always go up.

It’s hard to hold stocks for a long period of time. Josh and I are going to cover this and much more on tonight’s What Are Your Thoughts?

Subscribe to the channel. You’ll get a notification as the show is about to premiere each week.