Today’s Animal Spirits is brought to you by Nasdaq:

See here for Nasdaq’s research on the shifting profile of retail investors.

On today’s show we discuss:

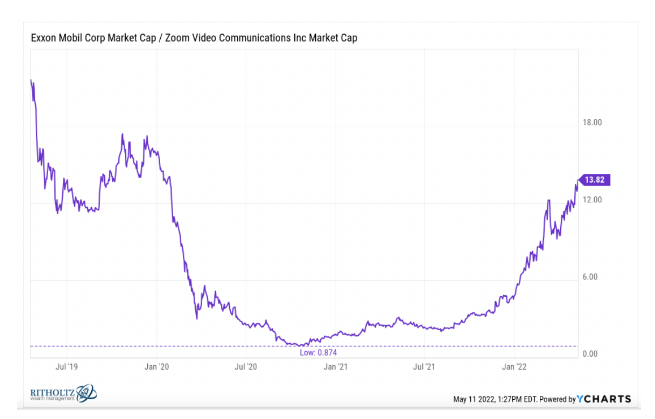

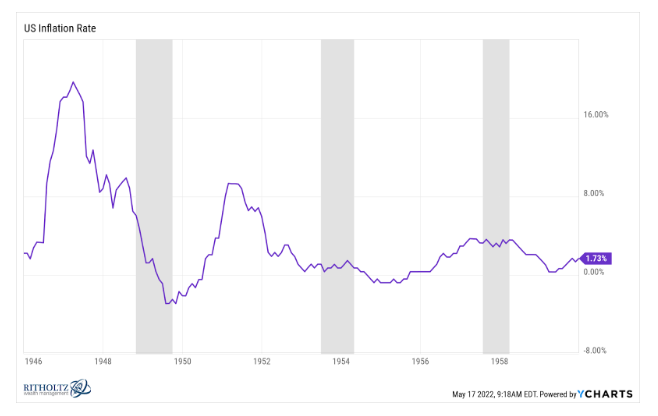

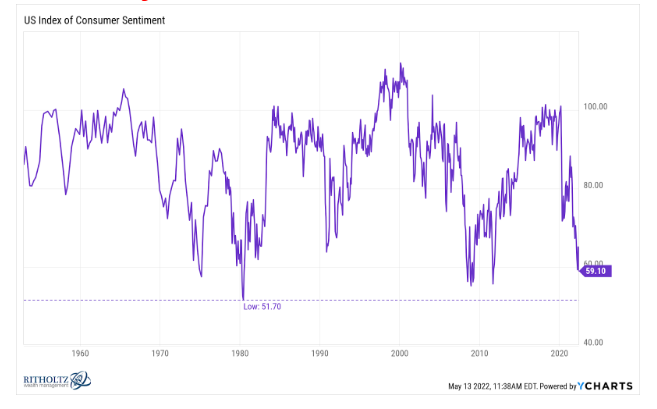

- Could inflation give us a wonderful buying opportunity?

- Bear market survival guide

- Elon trolling Twitter and the Luna situation

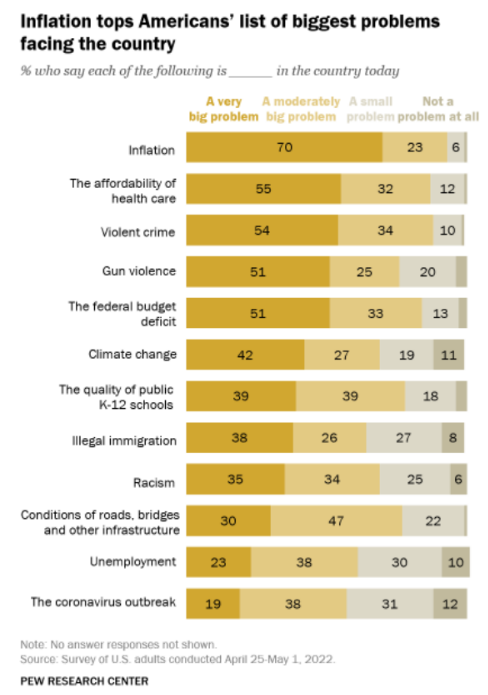

- Americans view inflation as the top problem facing the country today

- What will happen with house prices?

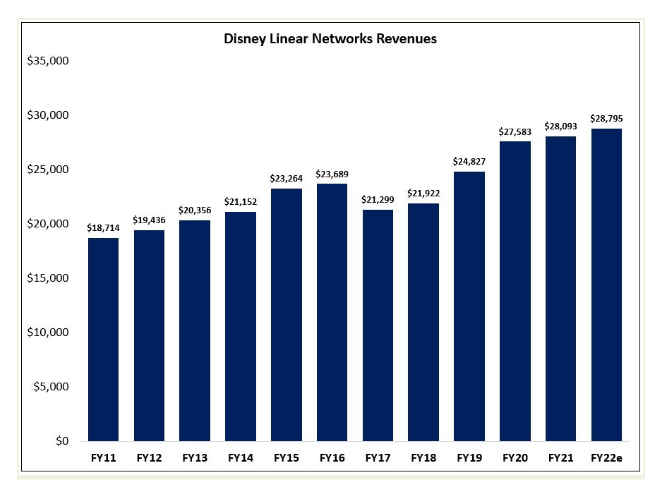

- Disney earnings

- The Science of Hitting on Disney

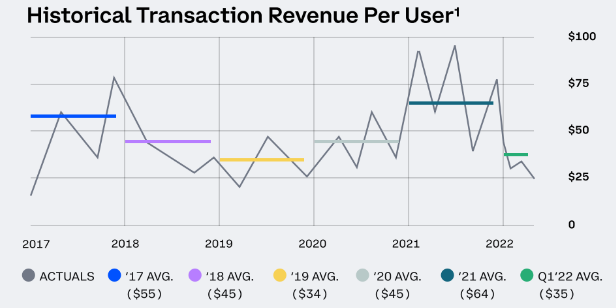

- Coinbase earnings

- Unity earnings

- Sam Bankman-Fried buys a stake in Robinhood

- a16z’s IPO hits fall hard

- 2022 energy report from JP Morgan

Animal Spirits NFTs:

- Animal Spirits Community NFT

- Reach out to Audiograph for support on Twitter or Discord

Listen here:

Transcript here:

Recommendations:

Charts:

Tweets:

https://twitter.com/cpabill/status/1525100910900301824?s=12&t=vD-L13sX2BPEthUWYiQ0cw

Looking back, what was the most obvious sign of the top?

— Ramp Capital (@RampCapitalLLC) May 11, 2022

When BTC hits $100k, I’m going to buy @GoldmanSachs and rename it Chamathman Sachs.

— Chamath Palihapitiya (@chamath) January 9, 2021

Look what you’ve created @federalreserve https://t.co/sMPxh0epNI

— Ramp Capital (@RampCapitalLLC) January 17, 2021

A volume spike is also missing. On avg, 10-day NYSE volume jumps 111% from the pre-waterfall low to the waterfall high. NYSE volume is up 32.4% this cycle.

The Nasdaq is the epicenter of the latest decline, but even there, volume has risen but not to panic levels. 3/5 pic.twitter.com/wui31eX2YI— Ed Clissold (@edclissold) May 16, 2022

1) Super bullish on megacap tech here – great inflation hedges, broadly growing revenue/gross profit over 10% with high ROICs, generally trading at all-time low EV/FCF and P/E multiples and almost all aggressively buying back stock.

All-time is a long time. This isn’t 08. Or 00.

— Gavin Baker (@GavinSBaker) May 11, 2022

During panics, correlations go to 1.

Not there yet, but climbing quickly among tech stocks.

There have been 493 days in the past 23 years when correlations were as high as they are now. Six months later, $XLK was higher 491 times. pic.twitter.com/CCT1gHRRQP

— Jason Goepfert (@jasongoepfert) May 6, 2022

Editors field stories they think readers want to read.

And what do they want to read about? Bear markets.

Last week, there were over 8,200 articles printed about them, the 2nd-most of any week in a decade (the furthest date in Bloomberg's database). pic.twitter.com/b5rIcMBpBc

— Jason Goepfert (@jasongoepfert) May 16, 2022

Bond mutual funds with another $20b in outflows last week, the 12th straight week of bleeding, YTD total now up to $137b. pic.twitter.com/l5oswHHLAo

— Eric Balchunas (@EricBalchunas) May 13, 2022

Used car prices are down three months in a row (according to Manheim).

Up 14% YoY is the smallest increase since July 2020.

This could be another clue that overall inflation is nearing a major peak. pic.twitter.com/Qn8KOyLTTa

— Ryan Detrick, CMT (@RyanDetrick) May 10, 2022

Commerce Secretary Gina Raimondo on why she doesn't want to lift tariffs on Canadian lumber:

"Lumber prices are down about 40%"

"The Canadians don't play fairly" (she cites stump fees)

"We're just trying to protect American industry"

"Not on the table" 2 waive these #SABEW2022 pic.twitter.com/ouPcW4Fmv5— Heather Long (@byHeatherLong) May 13, 2022

U.S. stocks are tumbling, but the wealthiest are ramping up spending on Hermes bags and watches

Luxury fashion spending **increased** 8% YoY in April -bofa

"Higher-income US consumer demand for luxury is accelerating, likely on increased occasions (weddings, vacations, etc" pic.twitter.com/o5ucvqNf0N

— Gunjan Banerji (@GunjanJS) May 16, 2022

It's been fifteen years since you could beat inflation with a savings account. pic.twitter.com/P1caOdhTsI

— Michael Batnick (@michaelbatnick) May 17, 2022

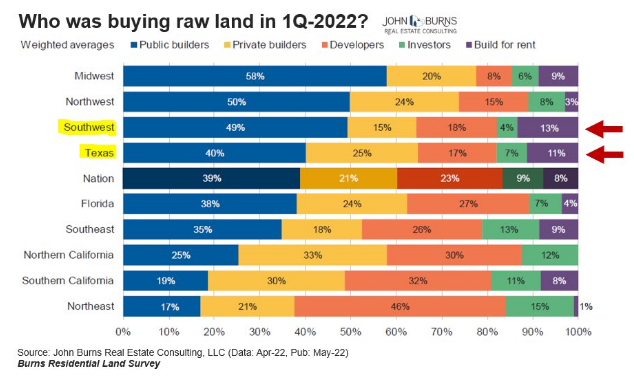

Build-for-rent (purple bars) reached 10%+ of raw land buying activity in Southwest & Texas during 1Q-2022. pic.twitter.com/jGOlNT25Yg

— Rick Palacios Jr. (@RickPalaciosJr) May 15, 2022

Disney+ to ~138 million global subs, up ~33% YoY $DIS pic.twitter.com/eYIneOBCdH

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) May 11, 2022

Peloton convinced rich people to pay $2000 for a bike AND to pay $20-$30 a month to use it. And still failed as a business

— 🧐 (@ShutupRuss) May 10, 2022

Tom Brady's contract with FOX Sports when he retires from playing is 10-years at $375M, according to the New York Post.

That $375 million is more than Brady has made from NFL contracts in his entire career (about $333M after this season).https://t.co/mglezWm2pb pic.twitter.com/CZvSUsp0LV

— The Athletic (@TheAthletic) May 10, 2022

@awealthofcs pic.twitter.com/72SIfXMa6c

— Spaceman Spiff (@dawarravi) May 11, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: