Today’s Compound and Friends is brought to you by Masterworks:

See here for important disclosures*

On today’s show we discuss:

- PayPal earnings

- Coinbase earnings

- November FOMC meeting

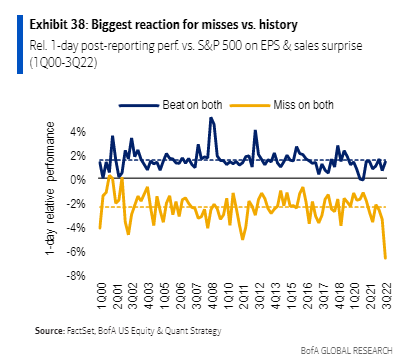

- Earnings season

- The Warren Buffet way still works

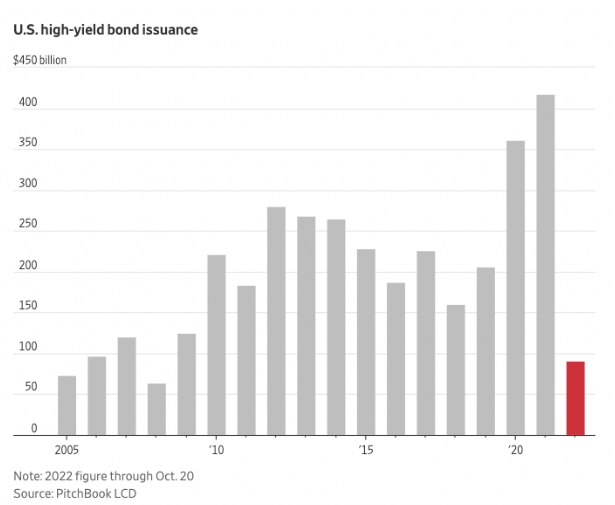

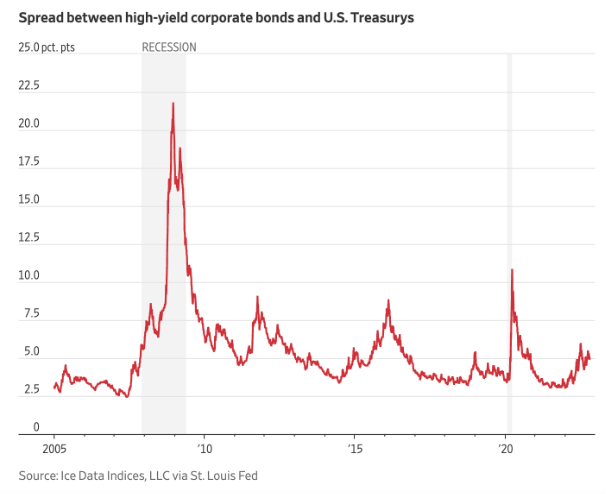

- Junk-bond deals on track for the slowest October and Year since 2008

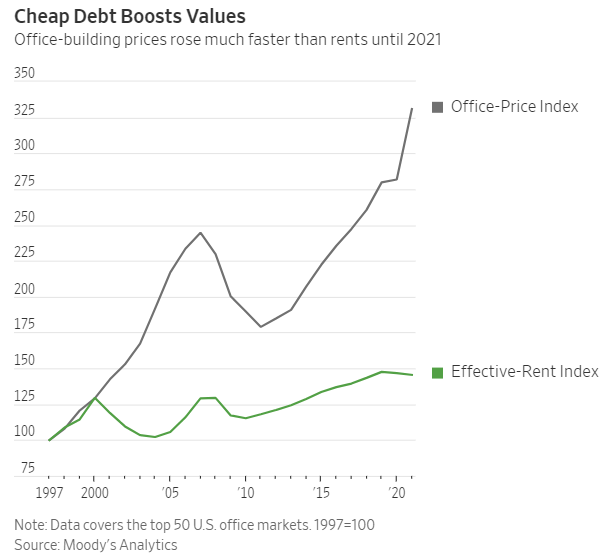

- Rising rates threaten to expose office building’s inflated values

Listen here:

Recommendations:

Carleton English:

Scott Krisiloff

Charts:

Tweets:

How much did markets dislike Powell's presser today? It was the worst last 90 minutes of a Fed Day for the S&P (-3.2%) since 1994 (when the Fed began announcing policy decisions on the day of the meeting).

Read our full analysis in tonight's Closer: https://t.co/MKhmUCp8DC pic.twitter.com/H5uouP2yqz

— Bespoke (@bespokeinvest) November 2, 2022

The Fed is trying to tighten financial conditions and keep them tight.

Talk about a Fed “pivot” can be confusing because a slowdown in the pace of hiking doesn’t necessarily mean an earlier end to hikes given the need to keep financial conditions tight https://t.co/IgfJO0copI

— Nick Timiraos (@NickTimiraos) November 2, 2022

We can safely call this an analyst forecast capitulation. S&P 500 estimates now falling for the two years ahead. pic.twitter.com/NNFuzyD0XP

— Gina Martin Adams (@GinaMartinAdams) November 1, 2022

While most companies are beating (lowered) earnings estimates, there is an unmistakable slowdown in EPS growth. Ex-energy, earnings growth for 2022 is expected to be a modest 1.8%, with risk to the downside. pic.twitter.com/PoTAs618no

— Jurrien Timmer (@TimmerFidelity) November 2, 2022

Gundlach:

“Tax loss selling is the biggest risk to the market going into year end. I believe this is the biggest tax loss selling opportunity in 2 generations”

— QE Infinity (@StealthQE4) November 2, 2022

Me/people getting pitched $TWTR by an ARKK Venture Fund on A16z backed Titan App TODAY after another rate hike of 75 beeps are not how tech bottoms are formed…actually it's distasteful !

I am wrong a LOT, but not about this (hope I am wrong …but I am not…but hope I am) pic.twitter.com/1x24st2IeX

— Coronado 'Porch' Lindzon (@howardlindzon) November 2, 2022

Contact us at askthecompoundshow@gmail.com with any feedback, recommendations, or questions.

Follow us on Instagram and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

*”Net Returns” refers to the annualized rate of return net of all fees and costs, calculated from the closing date to the sale date. IRR may not be indicative of paintings not yet sold, past performance is not indicative of future results.

**Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information.