Investors: “The market feels risky right now. I’ll just park my money in this high-yield savings account earning 5% and wait for the dust to settle.”

Stock market: LOL

A cruel irony of investing is that when you seek shelter, you’ll likely overestimate the probability of a storm. That’s exactly what we’ve seen since the October low, with $900 billion moving into money market funds from that time.

One of the most important things for investors to learn is that the bad news that you fear can come to fruition, but it’s likely that at some point, the market will have fully discounted whatever eventually comes to pass. That’s not exactly what happened this time around, but close enough.

The Fed aggressively raised rates to slow rising prices. The thinking behind this is that increasing the cost of capital should slow down the economy. Those actions should lead to lower earnings per share. Earnings drive stocks, and therefore, the market fell precipitously.

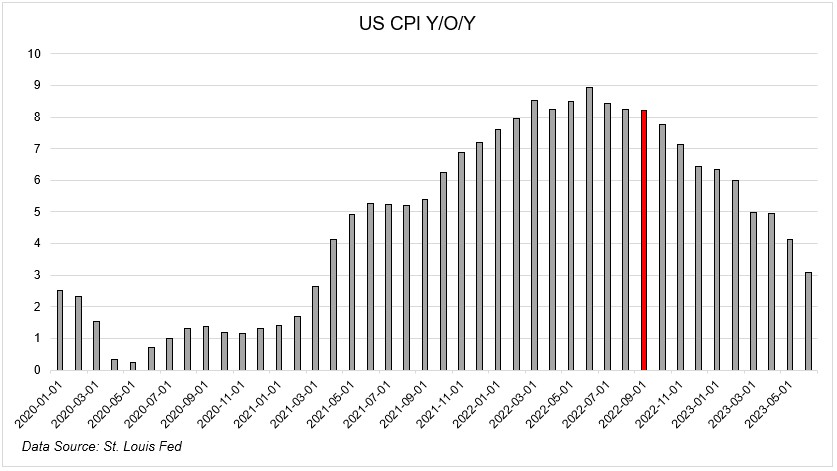

When the market falls because an agreed-upon set of circumstances is expected to worsen, in this case, higher rates leading to a recession, the collective group tends to overreact. The impossible thing about this is that you don’t know when enough is enough. That day, inexplicably, was October 13, 2022, when CPI came in way hotter than expected.

Inflation was running at 8.2% year over year, and 0.4% month over month. At the time, the Fed had already raised rates five times, with three consecutive hikes of 75 basis points. And they wouldn’t stop until their job was done.

Initially, the stock market didn’t like this news, gapping down 1.5% at the open, sitting 27% below its peak from earlier in the year. There was no reason to think that was the bottom, considering that the tightening had yet to impact the broader economy. If stocks were down this much when things were okay, what would happen if the economy actually weakened?

And then, just like that, somebody turned off the selling and the sun came out. The market closed up 2.5% on the session. And that was the bottom.

The S&P 500 is up 24% since the bottom. The Nasdaq-100 is up 42%. They’re both less than 5% away from an all-time high. I didn’t expect this. I don’t think anybody did. And all while you can get 5% risk-free in a money market fund.

The market has no mercy. It almost never does what you think it’s going to do. You have to let go of the illusion that you can outsmart it.

Every time the market either rises or falls more than you think it can, that should be a reminder that you need to have a game plan. Relying on your intuition is setting yourself up for disaster.