In 2015, Jeremy Grantham, the self-proclaimed bubble historian, wrote:

I consider myself a bubble historian and one who is eager to see one form and break: I have often said that they are the only really important events in investing.

I have come to believe, however, very reluctantly, that we bubble historians have, together with much of the market, been a bit brainwashed by our exposure in the last 30 years to 4 of the perhaps 6 or 8 great investment bubbles in history: Japanese land and Japanese equities in 1989, U.S. tech in 2000, and more or less everything in 2007.

For bubble historians eager to see pins used on bubbles and spoiled by the prevalence of bubbles in the last 30 years, it is tempting to see them too often.

On The Compound and Friends I read this quote and asked if he was guilty of being too eager to see a bubble now.

Is This a Real Estate Bubble?🏡

TCAF 110 with Jeremy Grantham is out now on all podcast platforms! Stay tuned for the YouTube drop later today⏯️🎙️

Apple🎧https://t.co/UXb0fOwUSf

Spotify🎧https://t.co/EuMyq4nLkm pic.twitter.com/PKpttKsQC0— The Compound (@TheCompoundNews) September 22, 2023

Grantham said:

I don’t think so. I think everybody else is guilty of the usual crime of expecting a soft landing when it never comes but is always claimed. Believing the Fed who has never gotten one of these bubbles right, regardless of the fact they have involved several different Feds. Underestimating the time that it takes for some of these things to work through, particularly real estate. And I’m sympathetic on that one because real estate is a global bubble. It has driven housing prices provably to multiples of family income all over the world.

I should have been more clear in my question. I was asking about the stock market, but Grantham said he sees a bubble in real estate. I agree with him that housing prices are out of control. However, I don’t see prices coming down 30%, which he said was a reasonable estimate.

High prices are necessary but not sufficient in order for something to be a bubble. You need speculation. You need euphoria. You need perception to be completely dislocated from reality. That’s not what’s happening now with the housing market. Prices are what they are for two structural reasons:

- People are trapped in their house due to the gap between rates today and rates they locked in.

- This is keeping supply low, and when you couple that with the other structural reason, 84 millennials who need a house, you get a nasty recipe for a completely broken housing market.

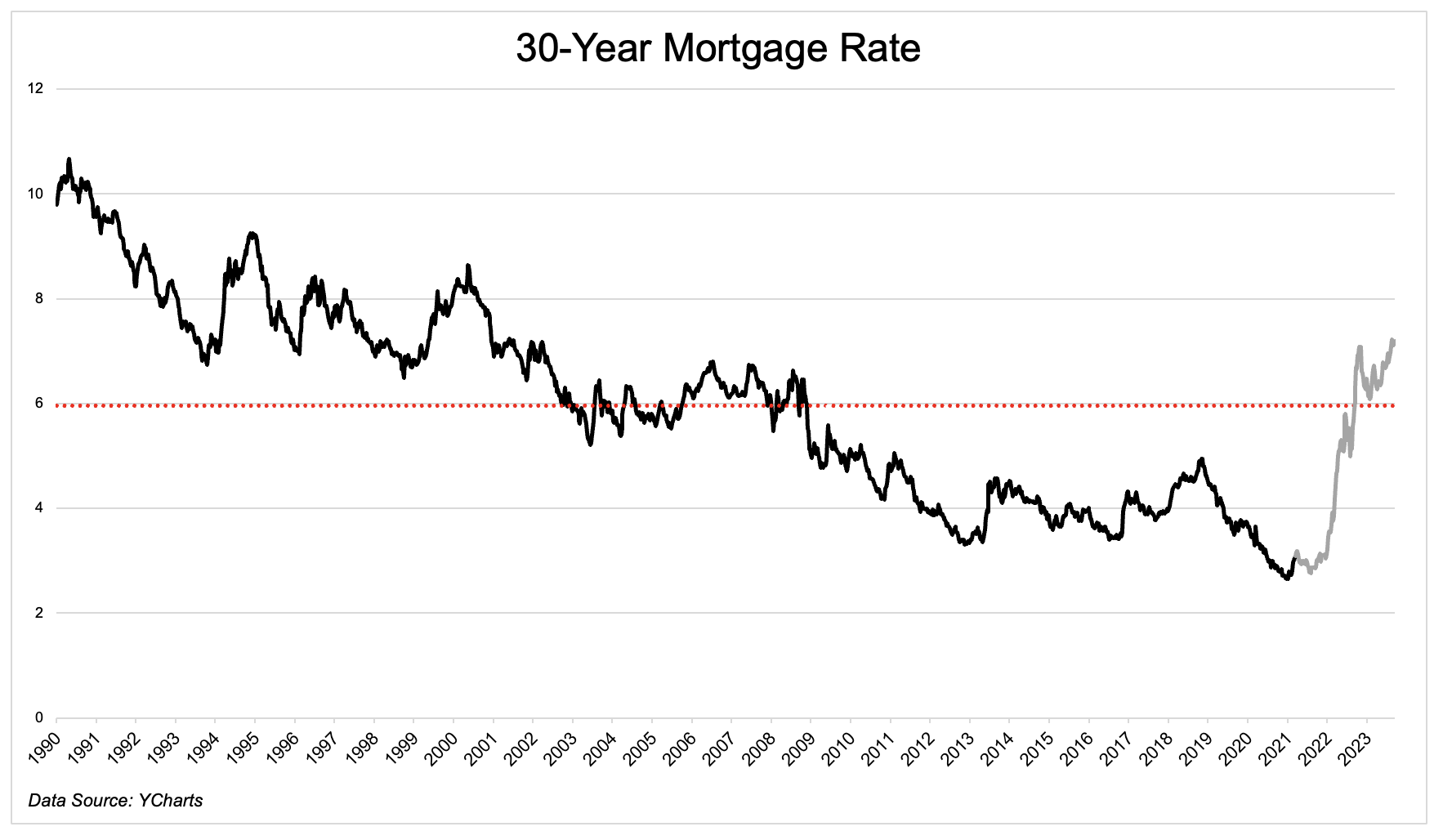

Before the Fed started raising rates in March 2022, mortgage rates were at an all-time low, and single-family home prices were at record highs. Now mortgage rates are screaming above 7%, higher than the average rate of ~6% since 1990. (The gray line is rates since the fed started raising rates in March 2022).

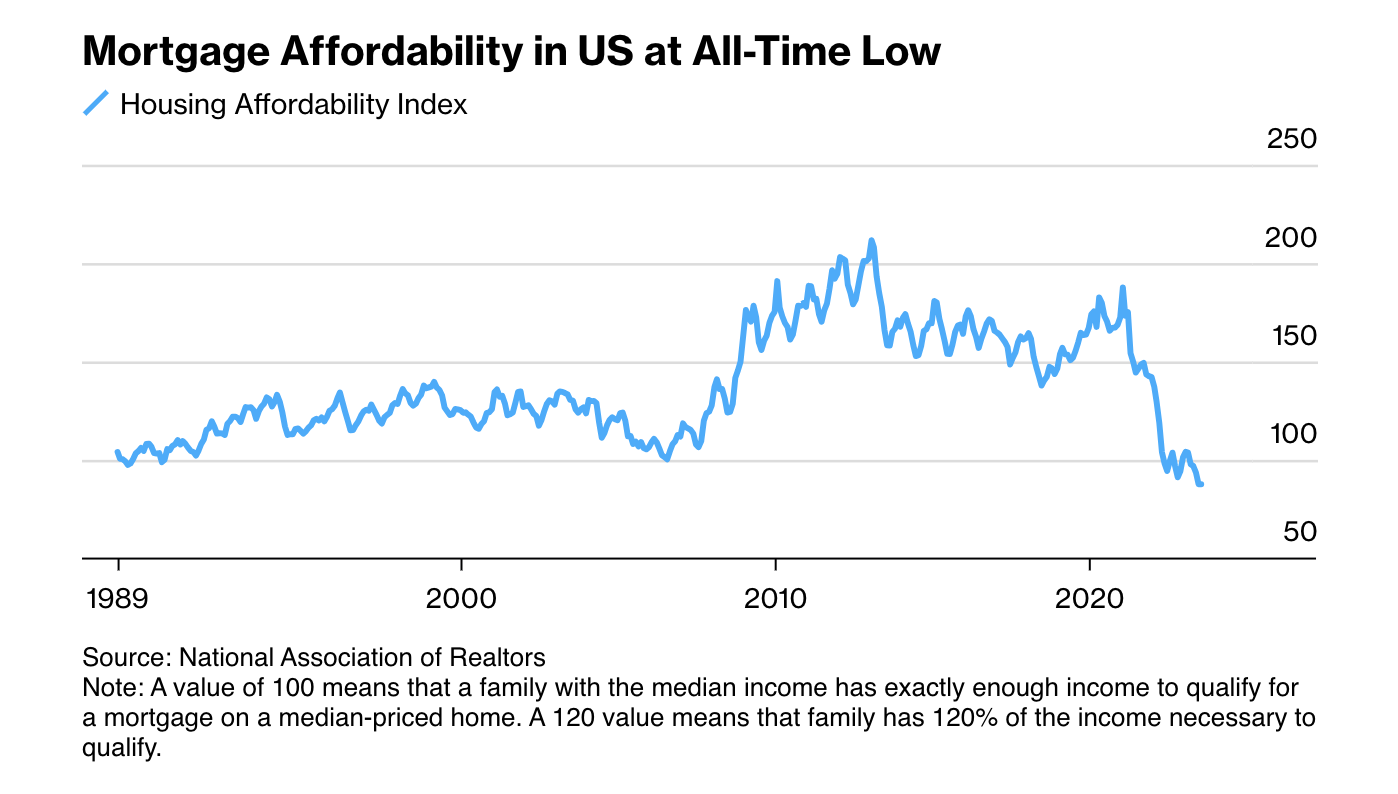

Rising rates aren’t pushing prices down for reasons that we’ll get to in a minute, but it is pushing affordability down to an all-time low. High prices and high interest rates are a lethal cocktail for would-be homebuyers.

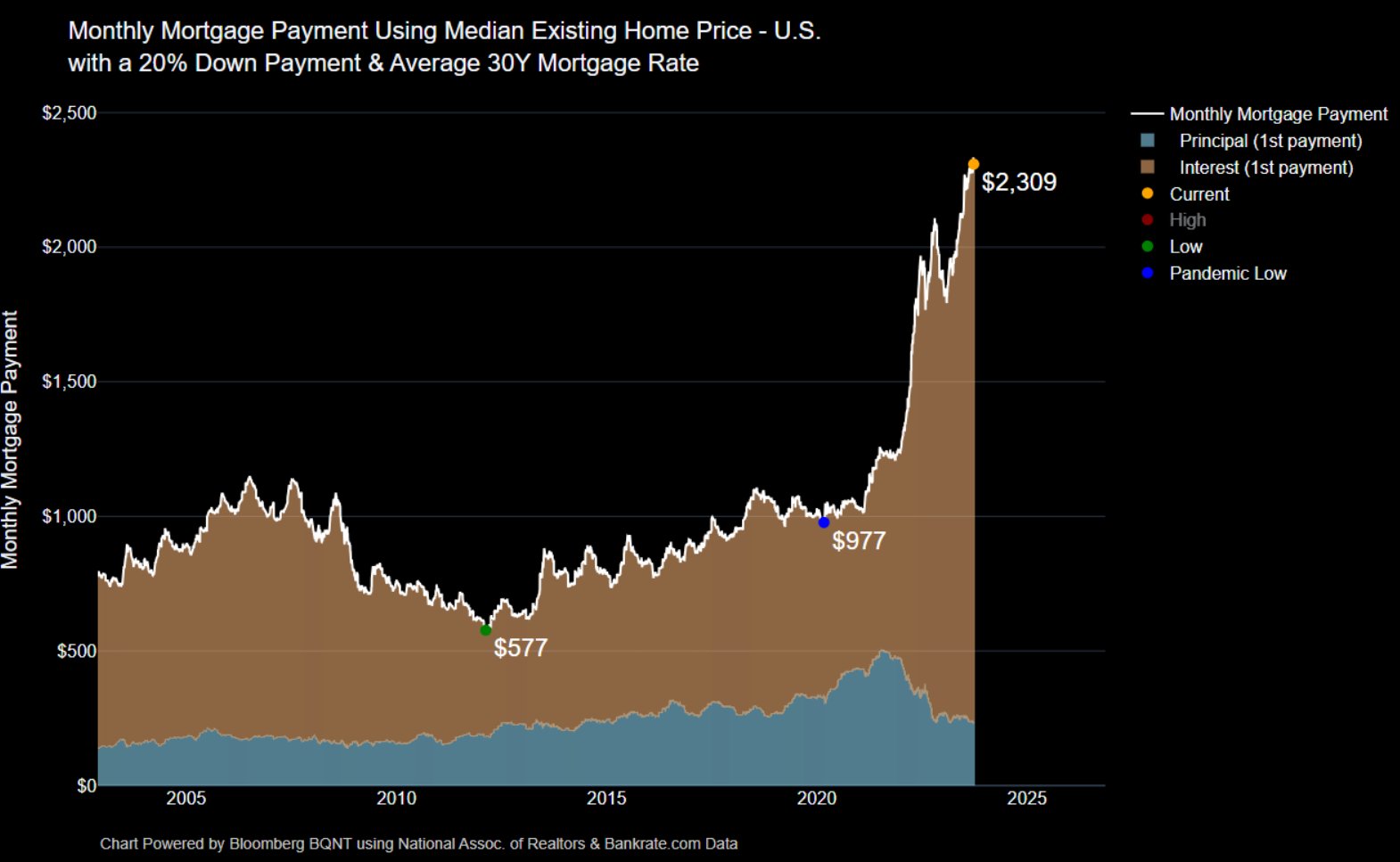

Before the pandemic, mortgage payments for the median existing home were $1,000 a month. Not even four years later, it’s up to $2,309, an increase of 130%.

How are people affording this?

Ramit Sethi tweeted a couple of screenshots from Reddit, where people were asking, “what % of your monthly income do you spend for your mortgage?”

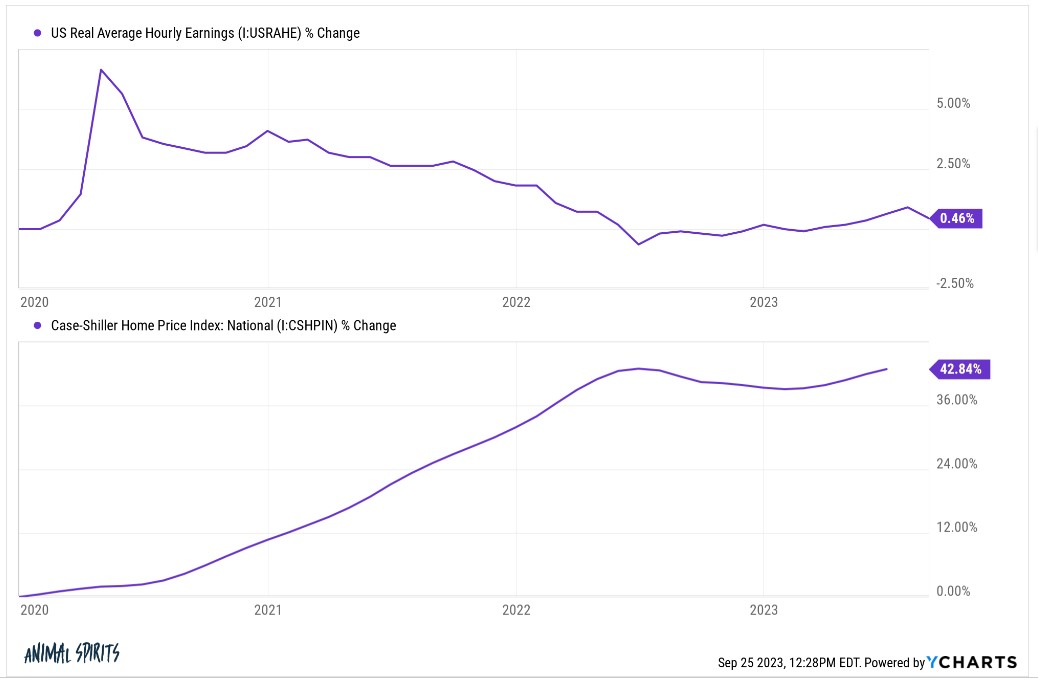

Several of the screenshots he clipped stated 40-50%. While not exactly a quantitative assessment of what’s going on, it’s clear that mortgage payments have risen much faster than income all across the country.

In a new fortune article, House Poor is Back: the New Normal for the Foreseeable Future, they wrote that 25% of homeowners are paying $3,000 or more a month on their mortgage. Meanwhile, average monthly earnings are $4,600. Even assuming two incomes, that’s not a ton of wiggle room.

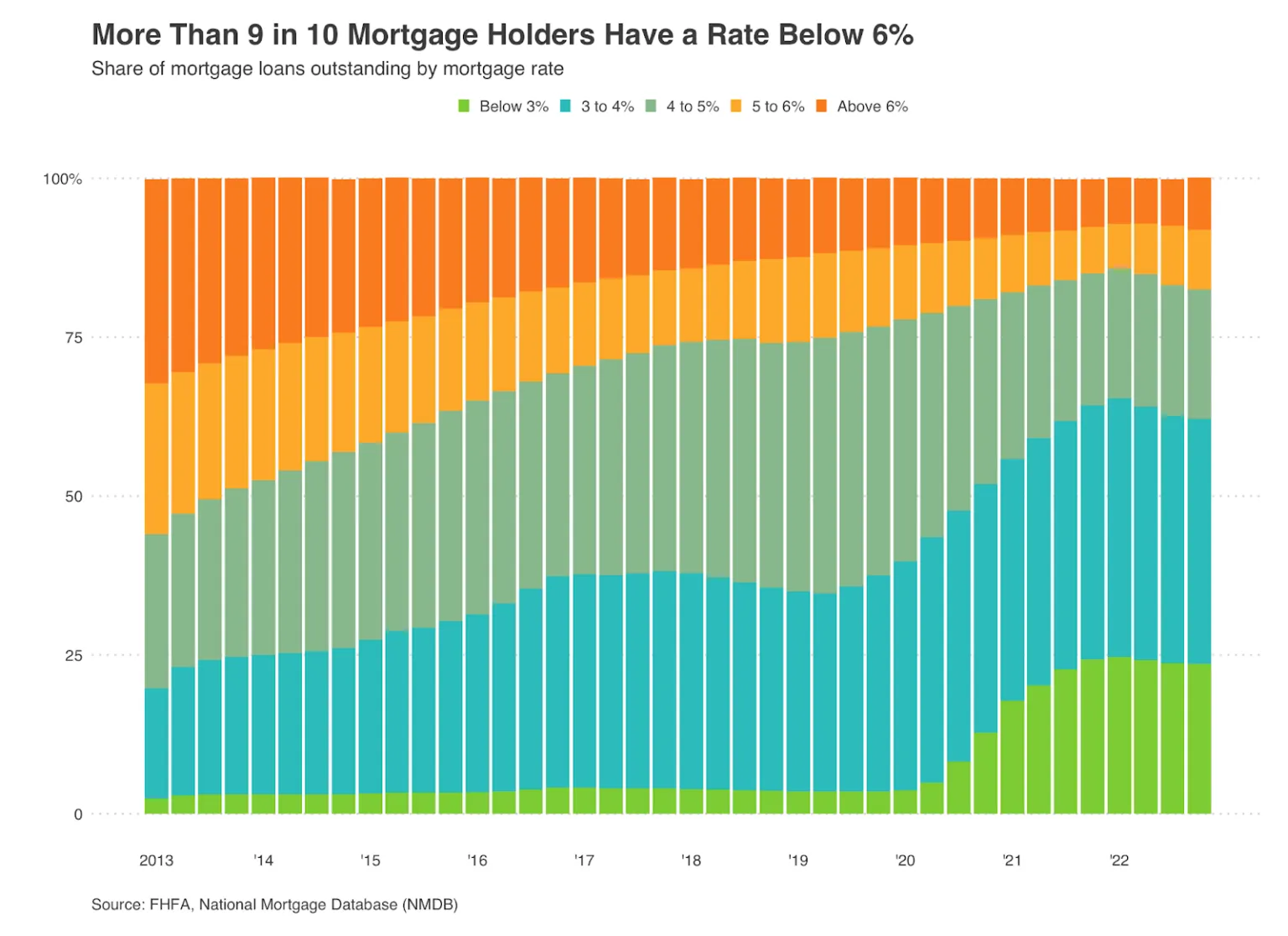

Housing hasn’t responded to rising rates due to structural reasons. With the 30-year mortgage near 7.5% and 60% of outstanding mortgages below 4%, would-be movers are trapped in their house. Moving makes absolutely no financial sense for these people, and so the supply of homes listed is low, and they will stay there as long as rates are where they are.

There are 84 million millennials in the United States who are of prime home-buying ages. These people are having babies and need to get into a house, and interest rates don’t dampen the need for more square feet. So again I ask, how are they affording this?

A new survey from Redfin showed that 38% of homebuyers under the age of 30 either used a cash gift from a family member or an inheritance for a down payment.

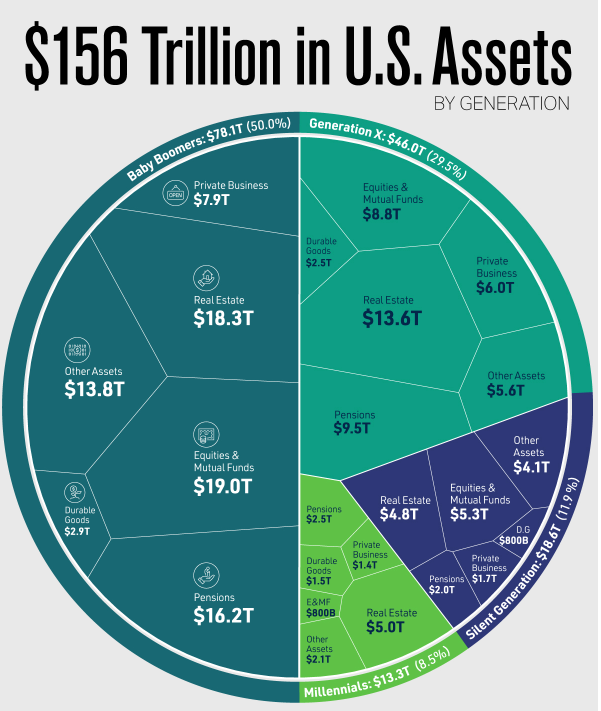

This trend should remain in place as long as prices are what they are, and it might in some small way help to accelerate the generational wealth transfer from Baby Boomers, who hold 50% of all assets, to millennials, who hold just 8.5%.

While it seems like something has to give, I think there is a high floor under residential real estate due to low supply and high demand. High rates for longer should keep a lid on home prices, but any relief in interest rates and my guess is we’ll see houses bid up like its 2021.

The housing market is broken, but I’m not worried about a Big Short redux.