Apple is bigger today than all of the top nine companies from ten years ago combined. Oh, and they bought back $600 billion of stock over that same time.

There is an ongoing debate about how much index fund flows are impacting the biggest companies. I’m sure there must be some impact on price, how can there not be? But I’m not sure it’s as drastic as some people make it out to be.

If index fund flows were the most important thing, then how could you explain why the S&P 500 outperformed J&J by 92%, Exxon Mobil by 127%, and General Electric by 211% over that time? Wouldn’t a negative 13% return (GE) over ten years be impossible if fund flows were pushing prices higher?

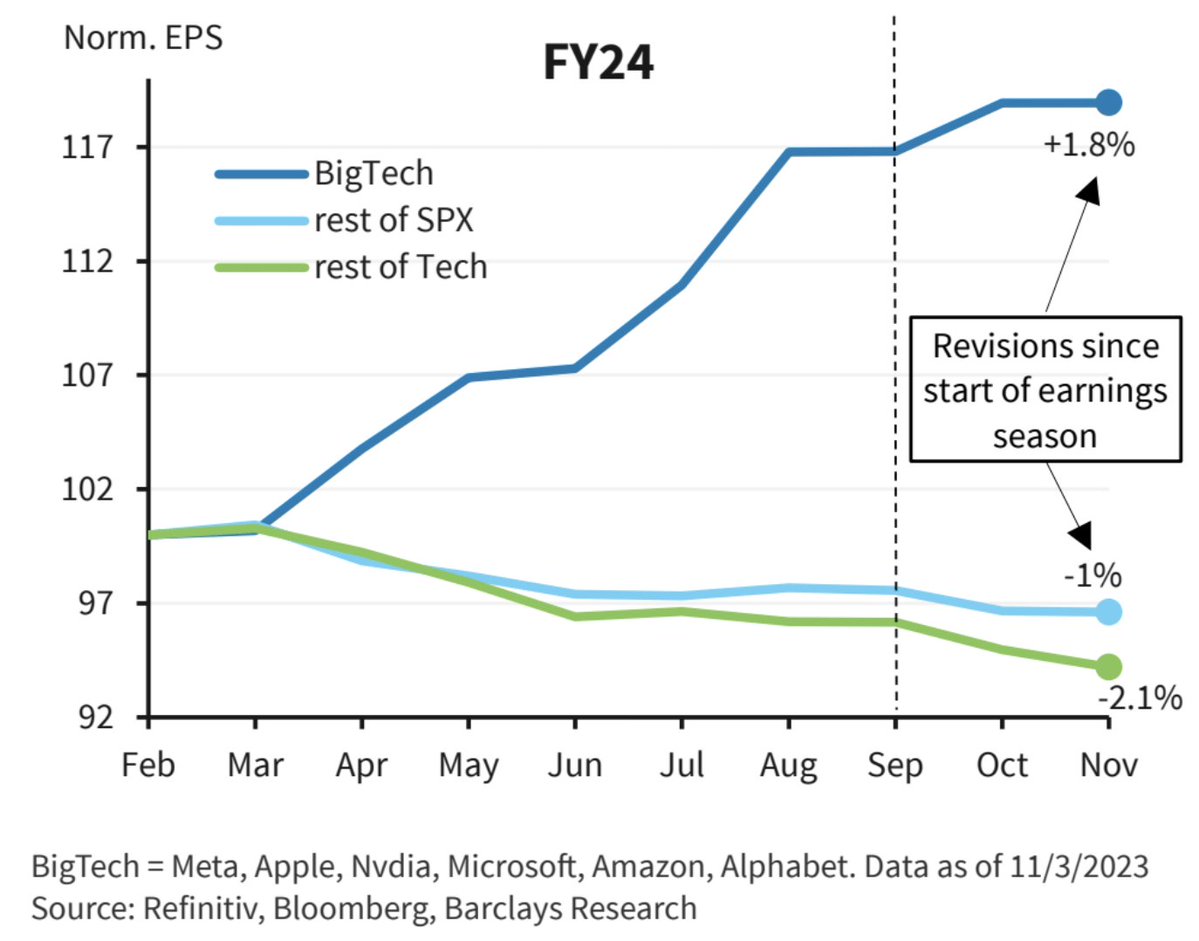

I think a simpler explanation for mega-cap tech’s dominance is simply because their businesses are dominating everything else. Apple, Amazon, Google, Facebook, and Microsoft did ~$100 billion in quarterly revenue ten years ago. They do ~$400 billion today. They continue to crush it even as some of the world is slowing down. This chart from Barclays shows that there is Big Tech and there is everything else.

Josh and I are going to cover this and much more on tonight’s What Are Your Thoughts?