Today’s Animal Spirits is brought to you by YCharts. Mention Animal Spirits to receive 20% off (*New YCharts users only)

Listen here:

On today’s show we discuss:

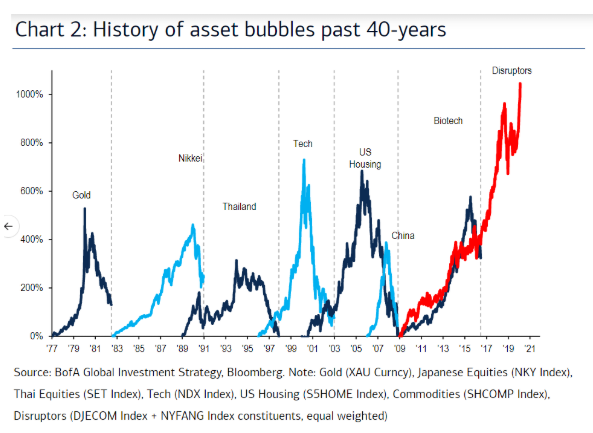

- My type of bear

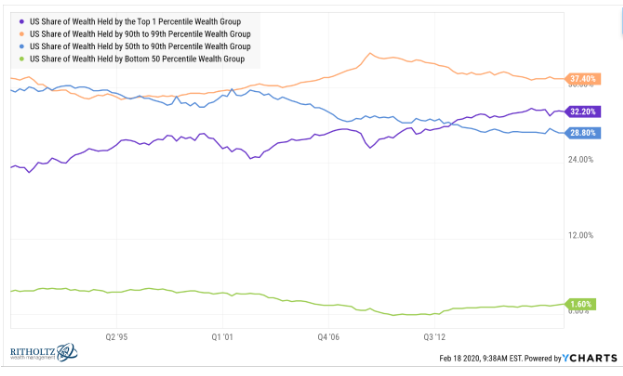

- The 1% own all the stock

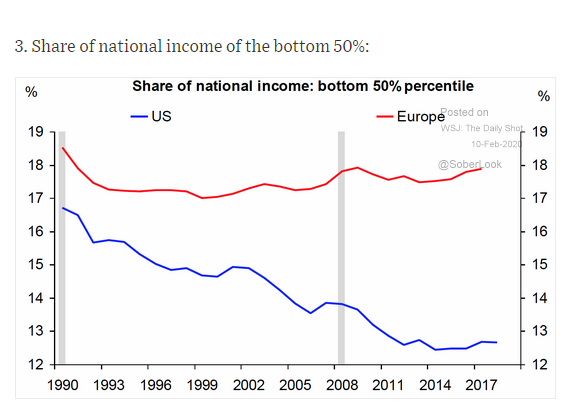

- The middle class has most of their money in their home

- White House considering tax incentive for stocks

- The great affordability crisis

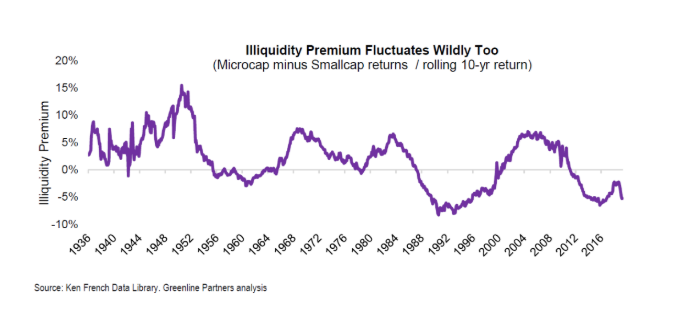

- Is private equity out of capacity?

- Private equity in target-date funds

- Don’t take investing advice from billionaires

- Big data will soon be table stakes

- What makes people happier than money?

Recommendations:

Charts:

Tweets:

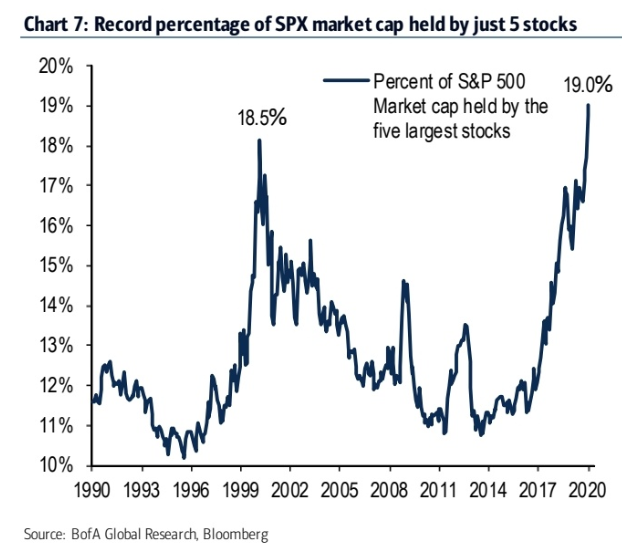

Yikes. Exclude the big 5 (Microsoft, Apple, Alphabet, Amazon and Google) and U.S. earnings were down 7.5% in the 4th quarter. H/t @AndrewLapthorne of SocGen

— John Authers (@johnauthers) February 17, 2020

Hedge fund guys publicly worrying (or straight slamming) index funds/ETFs is the norm. Pretty much every high profile one, w the exception of Cliff A, has done it (see below). Yet at same time, many of them use ETFs for liquidity or hedging tools. They're like frenemies.. pic.twitter.com/h2oRiWWi4c

— Eric Balchunas (@EricBalchunas) February 12, 2020

For anyone that wants to gripe about the concentration of the U.S. market, here's some context pic.twitter.com/8lPsVko8Qz

— Daniel Sotiroff (@DanielSotiroff) February 12, 2020

IMO – the best way to focus on the success of your customers is to hire great talent, and provide them with the culture, opportunities, and support they need to thrive. This award is awesome external validation that we are doing right by both our customers and our employees! https://t.co/val4X741Ou

— Sean Brown (@Sean_YCharts) February 5, 2020

Recommendations:

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: