Today’s Animal Spirits is brought to you by Interactive Brokers. Check out the Impact Dashboard here

On today’s show we discuss:

- Who cares about a correction?

- Einhorn quarterly letter

- Netflix is raising prices

- Portfolio tweaks before the election

- Rental market is hurting

- Ritholtz has a contrarian take on housing

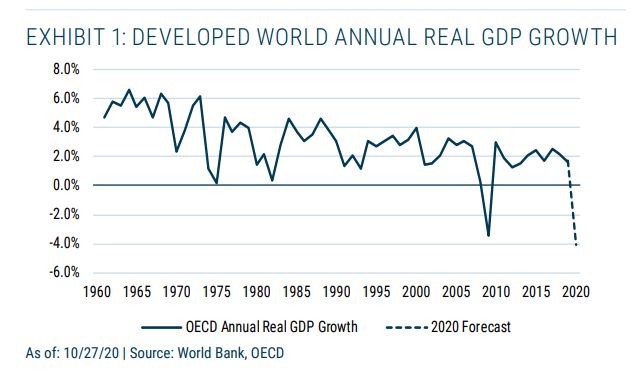

- The economy grew a lot in the third quarter

- Grantham on why we should go in on green infrastructure

- Cash is trash

- A cautionary tale

- Ken Griffin on taxes

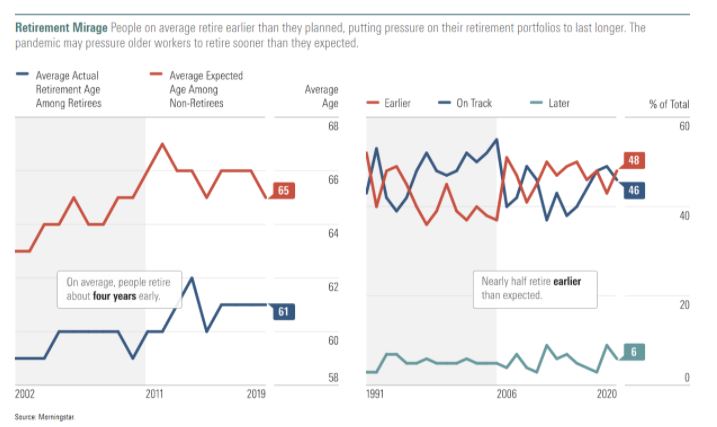

- Christine Benz on the future of financial planning

- Why FICO scores are higher

- This tool can help you with estate planning

- Survey of the week

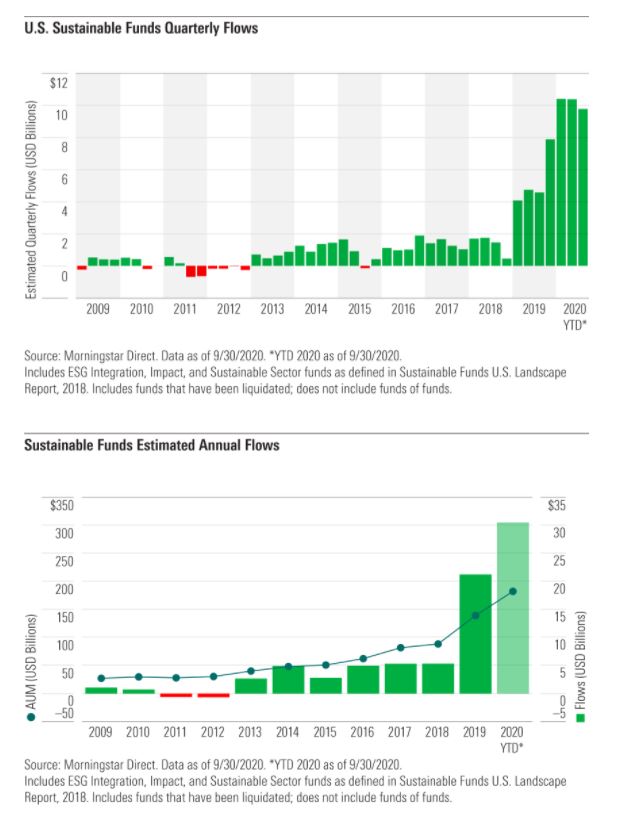

- ESG flows are picking up

Listen here:

Recommendations:

- Fooling Some of the People All of the Time

- Patrick O’Shaughnessy with Brad Gerstner and Rich Barton

- Chapelle and Letterman

- The Queen’s Gambit

- The Price we Pay

Charts:

Tweets:

GDP is 3.5% below Q4 '19 peak, 4.9% below where it would have been currently at a 2% annualized growth trend off that peak. And we're not going to see another sequential like we just got. pic.twitter.com/fq88xqtwMb

— George Pearkes (@pearkes) October 29, 2020

https://twitter.com/ballmatthew/status/1304526745001959424?lang=en

Amazon’s third quarter revenue:

2020: $96.1 billion

2019: $70.0 billion

2018: $56.6 billion

2017: $43.7 billion

2016: $32.7 billion

2015: $25.4 billion

2014: $20.6 billion

2013: $17.1 billion

2012: $13.8 billion

2011: $10.9 billion

2010: $7.5 billion

2009: $5.4 billion— Jon Erlichman (@JonErlichman) October 29, 2020

Interactive Brokers:

- Interactive Brokers launches innovative sustainable investing tool

- Impact Dashboard

- See how it works

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: