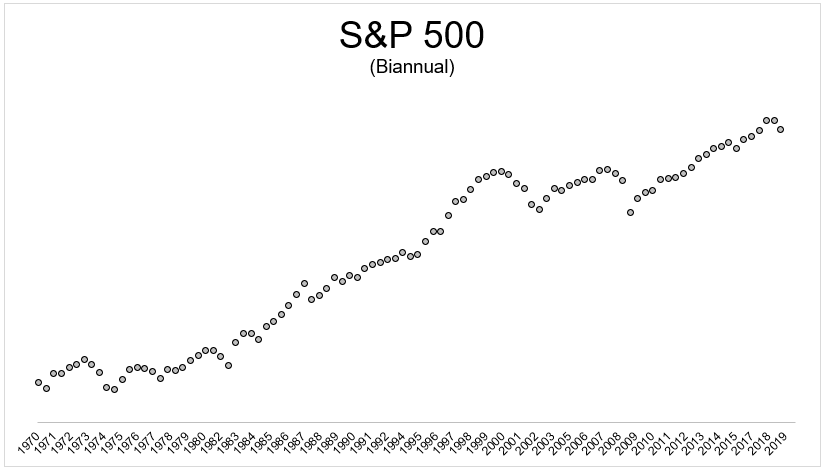

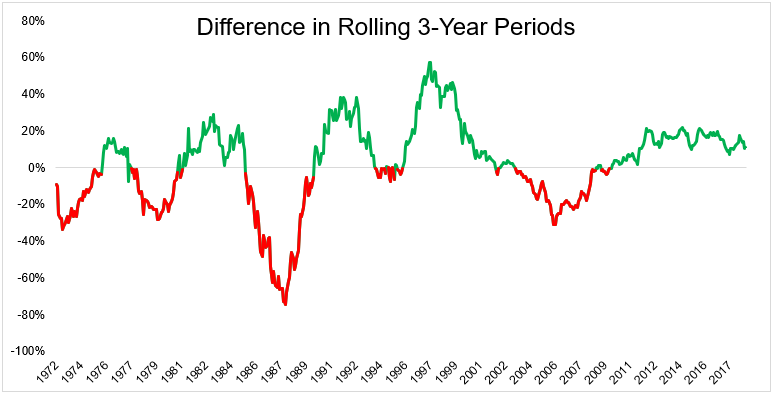

According to a recent Morningstar report, “shareholders of major U.S. stock market index funds have about 40% foreign exposure, as measured by corporate revenues.” Does this mean that U.S. investors already have plenty of overseas exposure, eliminating the need to diversify into international stocks? Let’s go to the scorecard. The S&P 500 destroyed international stocks since 1970,…